The Onomy cryptocurrency is a layer 1 blockchain built on the Cosmos network designed to drive the foreign exchange market through the coinage of virtual denominations of fiat currencies.

The rise of decentralized finance (DeFi) has paved the way for a number of innovative financial services that eliminate the need for intermediary entities that slow down financial transactions and raise fees. Many see DeFi as a 'strong competitor' that could ultimately bring down centralized finance (CeFi) and bring much-needed change to the global economic landscape.

The truth is that real progress can be made by not pitting these two worlds against each other, but by creating a bridge between them so that both can benefit each other.

In this article, we will discuss:

What is Onomy (NOM) token?

The Onomy cryptocurrency is a blockchain layer 1 platform built on the Cosmos network designed to improve the foreign exchange market. It is used to mint, trade and lend representations of national currencies called denominations (Denoms).

Various types of technologies run behind the Onomy Network, which include 'Cosmos' 'Tendermint Protocol' 'IBC Structure' and 'Equity.'

The Cosmos Ecosystem is based on the Tendermint protocol, which is the first functional Proof of Bet (PoS) consensus protocol. This protocol uses the IBC framework, a cross-chain functionality between Cosmos and other block chains.

Equity is a new consensus algorithm that provides the required transaction throughput and leaderless ordering, addressing validator execution.

Who are the creators of the Onomy cryptocurrency?

Lalo Bazzi, the founder and CEO of Onomy Protocol, along with co-founder and CTO Charles Dusek, envisioned a platform that would link the massive worlds of CeFi and DeFi.

Despite the opposing nature of these two financial spheres, they realized that bridging the gap between CeFI and DeFi could bring about a big change in the financial sector.

The goal of the Onomy Protocol is to fulfill this ambitious dream and help CeFi institutions to enjoy the enormous benefits of the blockchain's secure, reliable and fast transactions.

Onomy Products

- Onomy portfolio

- onomy validator

- Onomyt Bridge

- Omni Exchange

- onomy mint

- Onomy stake

- Onomy Link Curve Platform

- Onomy Liquid stake

NOM token

NOM is the native token of the Onomy Protocol and is used specifically to secure the network through stakeout and to serve as collateral for the minting of Denoms through the Onomy Reserve (ORES).

Onomy Decentralized Exchange (ONEX) provides detailed automatic market creation (AMM) price discovery used to rebalance the guarantee ratios of ORES minted accounts. OWL holders would also have collective governance on the platform as this would provide them with decision-making powers (through weighted NOM votes) to determine the direction of the platform.

Onomy also highlighted the main characteristics of the NOM, which include being malleable, sparse, transferable, durable, verifiable and fair.

NOM Staking Incentives

The platform will encourage NOM deployment with a double inflation schedule. Furthermore, the Onomy protocol said that its initial hyperbolic hyperinflationary period (with a maximum reward of 100% ARR inflation) would motivate network participants to bet and protect the network.

ONEX transaction fees and associated bridging liquidity pools will also serve as a reward for platform users who stake their NOM tokens.

Those who use NOM to coin Denoms can deposit NOM into ORES accounts and enjoy negative interest rates.

Participants who delegate or link NOM and Denoms to validators can receive an inflationary reward.

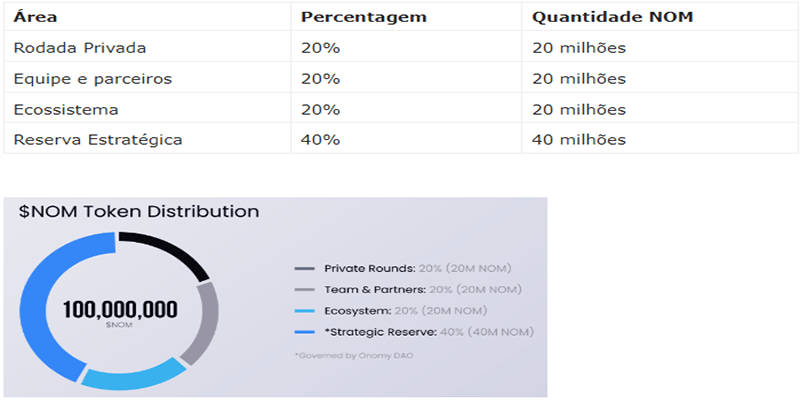

NOM token distribution

Onomy 3-pillar protocol

ONEX and ORES (just mentioned) are two of the most essential pillars of the platform. Onomy Network (ONET) joins them to form a complete and robust foundation for the Onomy protocol. Here is a detailed look at these three aspects.

Omni Exchange (ONEX)

Onomy Exchange is a decentralized base layer exchange used by Onomy users to trade NOM and Denoms and serves as a bridge between the Forex market and virtual currencies. ONEX works closely with Onomy Reserve to manage the maintenance of reserve accounts and rebalance warranty ratios.

Onomy Reserve (ORES)

The main function of Onomy Reserve is to govern the coinage of Denoms and use the NOM as collateral. Since Denoms is now a globally recognized substitute for its represented fiat currencies, the flow of money grows as Denoms becomes a more preferred means of payment because of its convenient, immutable and self-stabilizing P2P transactions.

On top of this, ORES can also provide stable currency loans based on collateral, which contributes to the overall progress of the DeFi market.

Onomy Network (ONET)

Onomy Network is a decentralized point-to-point computational network based on Cosmos that processes user-supplied transactions and rewards operators with NOM and uses a proof of bet (PoS) model. It directly solves the biggest blockchain issues in security, scalability, and decentralization.

NOM connection curve offer

The Bonding Curve offering is an automated market maker that provides platform users with a fast way to access NOM tokens and an instant market with liquidity and deterministic pricing.

Binding curves are cryptoeconomic token models that help automate price-to-offer transactions. In this model, tokens, called continuous tokens, are subjected to continuous calculations.

These tokens have a notable difference compared to their peers in that they don't go through ICOs or even token releases. Instead, continuous tokens are continually minted over time with the help of automated market maker contracts.

These processes, which are clearly out of the ordinary, help build platform sustainability and token demand and promote instant liquidity and deterministic pricing.

As described by the protocol, the binding curve models lack any central authority to issue the tokens. Buyers can simply buy a project token through a smart contract. The cost of tokens increases as the supply increases, and their price depends on the pre-existing algorithm.

Main benefits of the connection curve offer:

- Continuous Price – The price of token n is less than token n+1 and greater than n-1.

- Instant Liquidity – Tokens can be bought or sold instantly, with the binding curve serving as an automated market maker.

- Collateralization – In conjunction with the staking inflation curve, Ethereum acts as a reserve backing the NOM token.

- Deterministic Pricing – The bid and ask prices of NOM tokens go up and down depending on the number of tokens minted.

In Partnership with

The Onomy Protocol token has struck a deal with Avalanche, an open source platform for launching decentralized applications (dapps) and enterprise blockchain deployments, to establish a stable economy across chains.

Onomy and Avalanche believe that the enormous potentials of stablecoins can only flourish through a cross-chain environment, which has led them to collaborate and create an interoperable stablecoin economy.

The Onomy Protocol will create a bi-directional bridge to the world's leading blockchain networks and integrate their products into the Avalanche ecosystem, paving the way for the smooth trade of stablecoin pairs and native assets between Onomy and Avalanche.

Onomy 2021 Product Guide

first bedroom

Completed a link curve contract audit with help from the NCC Group, a UK-based information assurance company that handles high-level cybersecurity audits.

Second bedroom

Onomy Wallet, Exchange, Bonding Curve Platform, Bridge Hub and Network Mainnet underwent new developments.

Third quarter

TLA + audited and formally verified specifications used to dictate the main logical order book + AMM exchange solution.

Fourth trimester

It launched the first production versions of products and generated user incentives, feedback liquidity and growth campaigns.

Conclusion

The emergence of DeFi will certainly create winners and losers in the field of finance. Companies and institutions that are slow to adopt DeFi and continually resist its influence run the risk of missing not only the opportunity to enjoy the massive benefits of this growing trend, but also obsolescence due to their inability to adapt to the evolution of fintech.

But those who are quick to adopt blockchain technology and turn it into an innovative financial service will likely be rewarded with the success of openly embracing this revolutionary technology that advances financial freedom for all people around the world.