Cryptocurrency and U.S. stock futures traded sharply lower on Monday morning, fueled by fears in almost all global risk markets related to rising inflation.

Contracts on the S&P 500 and Nasdaq 100 fell more than 2% and hit their lowest levels since November 2020 during the overnight session. Dow futures are down more than 500 points, or about 1,7%. Treasury yields rose along the curve and the benchmark 10-year yield jumped to its highest level since late 2018.

Bitcoin's drop today is almost 14% in the last 24 hours and 19% in the last 7 days, trading close to $23.800, this level was last seen in December 2020. At the same time, Ethereum (ETH ) continues to fall, also trading at $1.200, down 18% on the day and 31% on the week, revisiting its lows seen only in January 2021.

What to expect for this week?

This week the entire global market is expected to adhere to the Fed's monetary policies. The central bank's last monetary policy meeting will be held on Tuesday and Wednesday, June 14 and 15, with the Fed and is expected to announce at least another 0,50% increase in its benchmark interest rate on Wednesday afternoon.

Wednesday's policy announcement at 14:14 pm ET, and will be followed by a press conference with Fed Chair Jerome Powell at 30:XNUMX pm ET. The Fed will also release its latest summary of economic forecasts on Wednesday, offering policymakers' forecasts for GDP growth, inflation and future rate increases.

After last Friday's inflation data, investors are now bracing for potential interest rate hikes later this week.

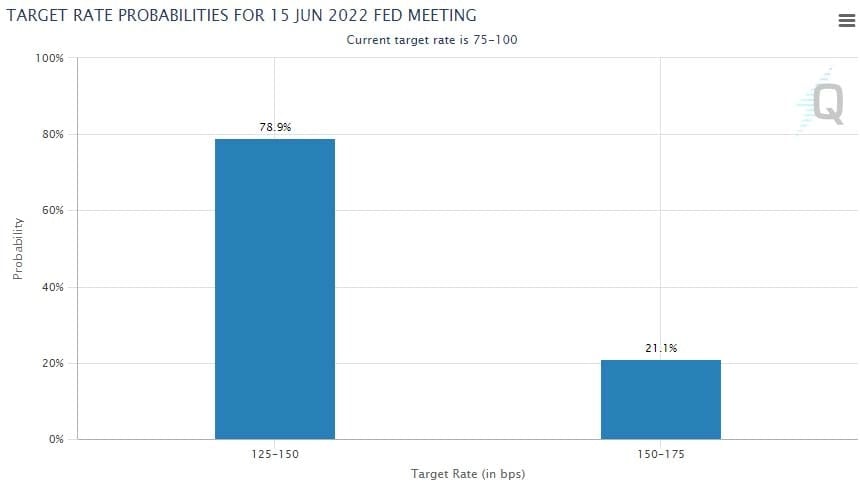

The rising risk of a 75 basis point rate hike this week can also be seen in the data derivatives exchange CME Group, which at the time of writing indicated a 21,7% chance of a 75 basis point increase versus a 78,3% chance. of a 50 point hike.

Source: CME Group

Although macroeconomic factors continue to weigh on the cryptocurrency market, sector-specific issues are also fueling bearish sentiment. Earlier today, cryptocurrency lending platform Celsius announced that it had frozen withdrawals, customer exchanges and transfers due to “extreme market conditions”. The development follows weeks of rumors that the cryptocurrency lender may face insolvency issues due to the decline in the cryptocurrency market.