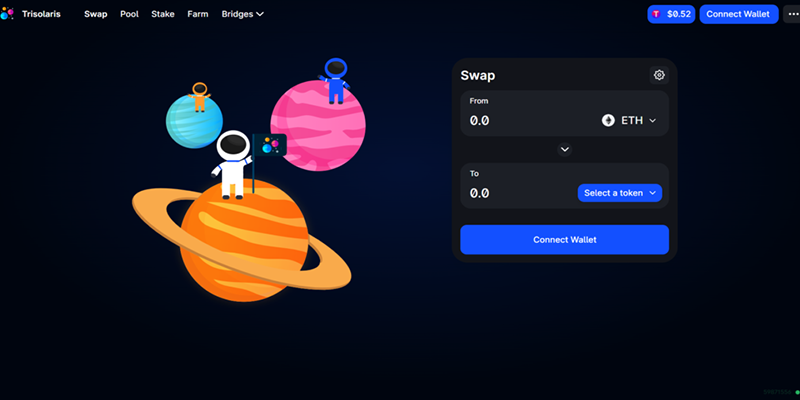

Trisolaris is Dex #1 on the Aurora engine, an EVM-compatible blockchain running on the NEAR ecosystem. The system can provide a low commission and high speed trading experience compared to Ethereum or Ethereum L2 solutions.

In this article, we will discuss:

What is Trisolaris (TRI)?

Trisolaris is a DEX built on NEAR Protocol's Aurora EVM, with fast settlement times, low fees, and democratic governance.

It has a user-friendly interface and is capable of providing liquidity, exchanging ERC-20 tokens and trading at high speed. The platform claims to be the best DEX on Aurora in terms of volume and total blocked amount (TVL). The platform also aims to gradually and systematically reduce emissions from its liquidity mining programs over the next 3 years, a program that has already started in February 2022.

How does Trisolaris (TRI) work?

The platform's Exchange has an easy-to-use exchange interface that involves simply selecting two tokens that users want to exchange, eliminating cumbersome steps. Liquidity providers power the Trisolaris Exchange and are rewarded with LP tokens for their efforts. A 0,3% trading fee is charged on each token exchange transaction, and 0,25% of this fee is funneled to liquidity pools, and the remaining 0,05% goes to the TRI token farm.

Income Farm

Trisolaris users can deposit their earned Liquidity Pool tokens into the platform farm to earn more TRI tokens.

Staking

Let's compare the benefits of staking and another earning option for users called 'autocomposers'. Auto Compounds allow users to sell their TRI rewards earned from yield farming to increase their LP ranks.

This earning option is attractive because of the seemingly large yields, but the problem is that it can decrease users' TRI tokens, which would be a big loss if the TRI increases in value. Alternatively, users are encouraged to stake their TRI tokens on “xTRI”, Trisolaris’ main staking mechanism, which has no temporary loss. By betting TRI tokens for xTRI, users can earn more TRIs simply by holding xTRI tokens, which would be extremely beneficial when the TRI price skyrockets.

StableSwap

Trisolaris' stable exchange feature is designed to provide an additional revenue stream for users and allow vexTRI holders to have governance in the allocations of selected revenue tranches. The platform's vote-locking feature and stable exchange features fit together seamlessly, increasing the utility of the TRI token and improving the platform's DEX performance.

stable MMA

Trisolaris' Stable Automated Market Maker (AMM) is designed to provide liquidity providers and traders with enhanced trading capabilities designed to improve their returns.

Benefits of Trisolaris Stable AMM:

- Liquidity Providers – They can infuse liquidity into an asset, and the temporary loss incurred is reduced with the help of the StableSwap invariant algorithm.

- Traders – They can trade stable pairs with the three benefits of higher capital efficiency, lower fees, and less slippage.

- xTRI Holders – They can benefit from TRI token buybacks that would be funded by a portion of the fees from the stableswaps. At the time of writing this article, this feature has not yet been implemented.

smart order routing

Smart-Ordering Routing automatically takes users to the AMM with the highest percentage of liquidity, lowest slippage and most beneficial execution when they are exchanging 2 assets.

TRI token

The TRI Token, which has a maximum supply of 500 million, is Trisolaris' native token with the primary utility of helping owners earn high yields on TRI-based farms.

vexTRI and Governance Participation

The token is also equipped with vote blocking and bounty boosting features, giving holders additional value in holding the token. Trisolaris users will have the ability to lock their TRI or xTRI for various periods of time in exchange for “vexTRI”. And in turn, vexTRI will give them the power to vote on critical decisions about Trisolaris governance. xTRI is the platform's main staking mechanism, which will be discussed in detail later.

These decisions include how many prizes to allocate to each pool, changes to DEX fee percentages, and which pools to include for liquidity mining. vexTRI also allows holders to earn more income over time and will continue to accumulate more single-sided staking TRI tokens.

Where to buy TRI token?

TRI cryptocurrency can be traded on the following exchange:

- Trisolaris

Trisolaris Price Forecast (TRI)

The price of Trisolaris is predicted to reach a maximum level of $1.449 throughout 2022. As early as 2023 according to our crypto price prediction index, Trisolaris (TRI) may reach a maximum level of $2.789, with the average price of $2.074 trade.

In 2025 according to our crypto price prediction index, TRI is expected to cross an average price level of $3.362. The minimum expected value of the Trisolaris price at the end of the current year should be $3.104. Furthermore, TRI can reach a maximum price level of $3.426.

Conclusion

Trisolaris is a DEX built on NEAR Protocol's Aurora EVM, with fast settlement times, low fees, and democratic governance. Trisolaris is clear about how it can provide better DEX services to its users and doesn't rely on flashy promises and features. Furthermore, what makes it stand out is that it is positioned as a direct platform for traders and liquidity providers looking for a DEX with functional solutions to increase revenues.