Learn all about the cryptocurrency Joe (JOE) an AMM-based DEX built on the blockchain Avalanche.

For ecosystems, the role of AMM DEX projects is extremely important because it is a fundamental operation in the DeFi space and has a great responsibility in attracting cash flow, liquidity and users that come to the ecosystem, for example Uniswap (UNI) on Ethereum (ETH) and Pancakeswap (CAKE) on Binance Smart Chain (BSC). Avalanche (AVAX) is an ecosystem with a lot of potential and Trader Joe (JOE) is currently an AMM DEX project in the launch phase at Avalanche (AVAX).

In this article, we will discuss:

What is Trader Joe (JOE)?

Trader Joe is an AMM-based DEX built on blockchain Avalanche. AMM projects on Avalanche (AVAX) are almost new, with most projects modeled after other famous projects on Ethereum and BSC, such as Pangolin and Zero Exchange modeled after Uniswap, or Olive and Lydia Finance modeled after Pancakeswap.

Though only recently went live, Trader Joe (JOE) surpassed Pangolin (PNG) to become the AMM DEX with the largest TVL in the Avalanche ecosystem by hitting $500 million in TVL in August.

How does the Trader Joe platform work?

The special feature of Trader Joe is that it combines DEX and Lending & Leveraged Trading, which helps to promote liquidity and attract more money to the project.

In the DEX section, Trader Joe is one of the first to plan the execution of limit orders, which overcomes the weakness of decentralized exchanges in price slippage. If Trader Joe can successfully achieve this goal, they will be able to gain a significant advantage in the DeFi market.

Trader Joe is a DEX whose main responsibility is to provide exchange and trading services. However, this project also provides other basic DeFi features such as stakeout, crop production, and borrowing. Furthermore, Zap is a new project feature that allows users to exchange for LP tokens with just one click.

The project didn't have a fair launch event, meaning they didn't pre-sell the tokens to increase investment, most of the JOE tokens were allocated for liquidity.

Trading

Exchange is where you can exchange one token for another. It's a simple exchange interface, just select the two tokens you want to exchange.

The liquidity provided to the exchange comes from Liquidity Providers (“LPs”) who place their tokens in “Pools”. In return, they receive LP (Liquidity Provider) tokens, which can also be wagered to win JOE tokens on the “farm”.

When you exchange a token (trade) on the exchange, you pay a trading fee of 0,3%, which is divided as follows:

- 0,25% – Paid to liquidity pools in the form of trading commission to liquidity providers.

- 0,05% – Submitted to the JOE token set.

Liquidity Pool

Trader Joe charges a fee of 0,3% for all trades, of which 0,25% is added to the liquidity pool of the token pair that was traded.

A liquidity pool (LP) is a pool of two tokens, for example, AVAX and JOE Tokens. This pool is what allows users to switch between the two tokens automatically.

Users can earn a share of trading fees by depositing a pair of tokens into the LP (also known as “liquidity addition”). Users will receive an LP token representing their participation in the LP.

Yield Farm

- Deposit your Liquidity Pool tokens at a farm to earn extra income.

- The extra income is rewarded in $JOE Tokens.

Staking

xJOE is the primary stakeout engine in the Trader Joe ecosystem. When you bet your JOE, you effectively exchange your JOE for xJOE. Over time, you will always earn more JOE by holding xJOE tokens.

This is because for every trade in Trader Joe, a 0,05% fee is charged and sent to the xJOE pool. This fee is used to purchase JOE tokens periodically (rebuys currently take place every 2 days). So when you trade your xJOE for JOE, you'll get more JOE than what you started.

DeFi lending protocol

Trader Joe is a complete decentralized trading platform on Avalanche. Banker Joe is Trader Joe's loan protocol based on Compound protocol. Next, we'll show you how the loan protocol can be combined with our decentralized exchange to provide leveraged trading without custody.

What is the JOE cryptocurrency?

JOE is Trader Joe's native token, as well as the governance token that rewards its holders with a share of the trade's revenue.

JOE Token Metric

- Token name: Trader Joe (JOE).

- Ticker: JOE.

- Blockchain: Avalanche.

- Token Standard: ARC-20.

- Contrato: 0x6e84a6216eA6dACC71eE8E6b0a5B7322EEbC0fDd

- Token type: utility, governance.

- Maximum supply: .500.000.000 JOE.

- Total supply: 133.413.633 JOE.

- Circulation supply: 71.961.457 JOE.

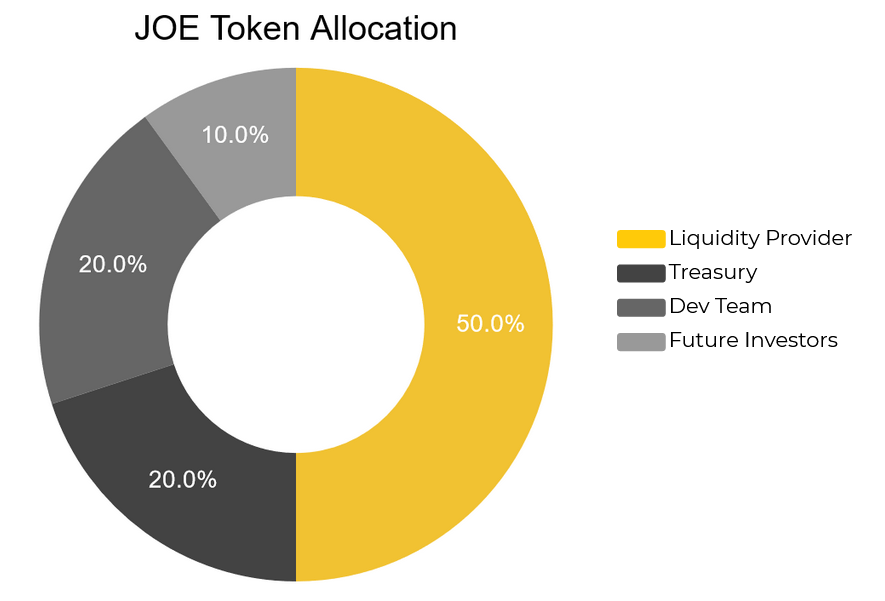

JOE Token Assignment

- Liquidity provider: 50%

- Treasure: 20%

- Development team: 20%

- Future investor: 10%

JOE cryptocurrency use case

The JOE token will be used for 2 purposes:

Governance: allows incumbents to vote on community proposals. The proposals will be decided with JOEVOTE:

- Each JOE in the JOE-AVAX pool is worth 2 JOEVOTE

- Each JOE held by xJOE tokens is equal to 1 JOEVOTE

- Each JOE token is worth 1 JOEVOTE

As a reward for token holders: Stakers, Farmers, Liquidity Providers.

When you bet your JOE, you effectively exchange your JOE for xJOE, for each exchange on Trader Joe, a 0,05% fee is charged and sent to the xJOE pool. Over time, you will always earn more JOE by holding xJOE tokens

How to buy JOE cryptocurrency?

JOE can be purchased on several major cryptocurrency exchanges, some of the larger ones are:

- Gate.io

- FTX

- Global MEXC

- Binance

- BKEX

Project team, investors and partners

Staff

- Cryptofish (Co-Founder) : is an original contributor to several Avalanche projects such as Snowball, Pandaswap and Sherpa Cash. More recently, he has worked at Google and a CEX specializing in derivatives.

- 0xmurloc (Co-Founder) : is primarily responsible for Trader Joe's (JOE) products and programs. He has founded several startups and was most recently Senior Product Manager at Grab.

- Hruday (Front End Engineer) : Hruday is a Front End Engineer with over 5 years of experience and has worked on various cryptographic projects through the DAO developer collective, RaidGuild.

Investors:

Trader Joe (JOE) recently raised $5 million in investment, with key investors being DeFiance Capital, GBV Capital and Mechanism Capital. Other backers include Three Arrows Capital, Avalanche Foundation, Delphi Digital, Coin98 Ventures, Not3Lau Capital and Aave founder Stani Kulechov.

Trader Joe's two main investors, Defiance and Mechanism Capital, are two funds that have a strong interest and investment in Defi, both involved in support and consulting projects they invest in to build space. Defi is more effective. There is currently no information on Trader Joe (JOE) receiving support from these investors, but being selected by two funds with very deep insight into the Defi segment shows that this project is very promising.

Another highlight is the emergence of a famous Three Arrows Capital fund. As mentioned above, Defiance Capital is a leading investor with a strong focus on Defi's potential. One special thing is that Defiance Capital also received investments from Three Arrows Capital, so why did Three Arrows Capital still invest in Trader Joe (JOE)? Three Arrows Capital is a hedge fund, so they will be more interested in stability and the long term. This means that Trader Joe (JOE) has potential development opportunities in which Defiance Capital is very interested. The project is also a highly secure investment option that suits Three Arrows Capital's investment style.

Is Trader Joe (JOE) a good investment?

Trader Joe (JOE) has a number of advantages like the integration of the utility product for the users, the Lending and Leverage and Limit order mechanism that will definitely make the project stand out in the market. It also has a large project team, new investors and there is a big opportunity coming for the Avalanche ecosystem (AVAX) when the Ethereum Defi space has not yet resolved the gas rate and transaction speed issues.

Trader Joe (JOE) is the leading DEX in the Avalanche ecosystem, which has great potential for growth and Trader Joe (JOE) will play an important role in the development of the ecosystem. If Avalanche can grow and become a major player in the market, we can expect Trader Joe (JOE) to reach the same position as pioneering AMM DEXs like Uniswap (UNI) or Sushiswap (SUSHI) have achieved in the Ethereum ecosystem.

On the riskier side, the Trader Joe (JOE) token will be released according to the fixed schedule over the next 2 years, so the biggest concern of the project is to attract users and maintain the customer base. With the strong development of Defi, competition between projects is increasing, so the pressure on Trader Joe (JOE) is to maintain product quality and continue to expand features and utilities to attract customers.

JOE (JOE) 2025 Price Prediction

According to our crypto price prediction index, in 2025 the JOE price should cross an average price level of $8.901, the minimum expected JOE price at the end of the current year should be $9.833. Additionally, JOE can reach a maximum price level of $10.532.

JOE (JOE) 2030 Price Prediction

The JOE price is forecast to hit the lowest possible level of $10.765 by 2030. According to our crypto price prediction index, the JOE price could reach a maximum possible level of $17.522, with the average forecast price of $13.561 .

Conclusion

In conclusion, Trader Joe (JOE) is currently an outstaning AMM DEX project in Avalanche (AVAX), the role of AMM DEX projects is extremely important as it is a fundamental operation in the DeFi space. With the strengths of the model, investors and users, Trader Joe's potential will be able to go even further.

You read an article about Trader Joe (JOE) and the JOE token. I hope it helped you to gain more valuable information about this project and to understand its potential. This article is not financial advice and you should do your own research before conducting any investment.