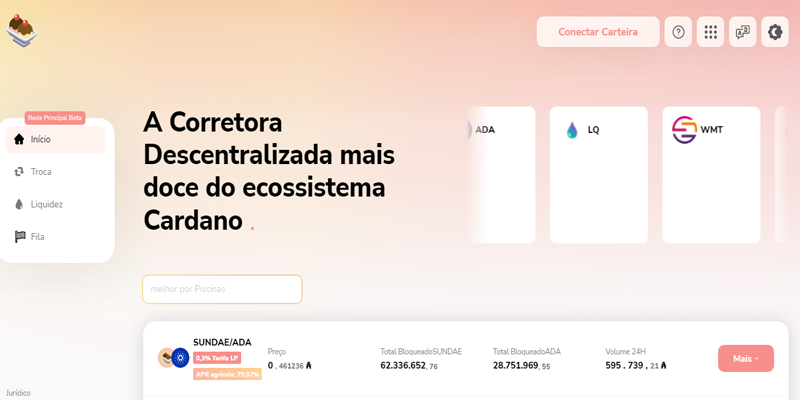

SundaeSwap is a decentralized trading protocol that will run natively on Cardano (ADA). The decentralized exchange (DEX) is the first of its kind on the Cardano blockchain.

In this article, we will discuss:

What is SundaeSwap?

SundaeSwap is one of the most popular Cardano-based decentralized exchanges which has a large following on social media. The native SundaeSwap currency, known as SUNDAE, is used to power the platform. In December 2021 we saw the launch of SundaeSwap Testnet where they showed what the project would look like.

In other words, SundaeSwap is a native and scalable decentralized exchange and automated liquidity provisioning protocol, and it is a Cardano SundaesWap DEX. In terms of utility around the SUNDAE token, it will be used for governance, profit sharing and reduced fees. There's a lot of SundaeSwap news floating around, but before that, let's meet the team behind the project.

How does SundaeSwap work?

SundaeSwap is essentially the Uniswap for Cardano in its current form. Furthermore, as an automated market maker, it has liquidity pools in which liquidity providers allocate two assets. Additionally, these liquidity providers receive LP tokens for their liquidity contribution. Differentiating SundaeSwap is the use of a “Constant Product Pool” model, which increases trading efficiency. It is important to note that – because Cardano works on the Extended Unspent Transaction Outputs (eUTXOs) model as opposed to the UTXO model – there are some challenges that come with implementing AMMs.

To facilitate exchanges, SundaeSwap uses a “SundaeSwap Pool Factory” token which, in conjunction with a minting policy, ensures that asset pairs are unique. This reduces liquidity dilution and low slippage. However, regarding the issue of competition around the eUTXO model, the team clarified the issue by providing three possible solutions. The first is to create a DEX without a single liquidity portfolio, the second is to use an order book model, and the last is to use a hybrid model for the exchange.

However, SundaeSwap says they have a different solution that will solve this scaling issue in the future. They haven't revealed many details about it yet, but they say it's coming soon. But, in addition to this peculiarity of the particular accounting model that comes with the use of blockchain From Cardano, SundaeSwap works in almost the same way as Uniswap – at least in the initial version. However, future updates may result in a very different DEX.

What makes SundaeSwap stand out?

We can see that Uniswap's design inspires SundaeSwap. But this model is adapted to the Cardano network, which has some peculiarities compared to Ethereum. One such unique feature of SundaeSwap is the Constant Product Pool which makes the exchange more efficient. But SundaeSwap stands out from traditional AMM models as the Cardano blockchain has a different accounting model and virtual machine. The team knows that the solutions it proposes are nascent and that they can be improved.

As such, they treat this first implementation as preliminary, with future improvements and updates being key to the growth of the decentralized exchange (DEX). This is true for the Cardano blockchain as a whole, which is slowly but surely refining and adding new features to its network.

SUNDAE token

The native cryptocurrency token used in SundaeSwap is known as the SUNDAE token, and let's look at the distribution of the SundaeSwap token. 2 billion SUNDAE tokens are minted at the start of DEX and are intended to become available slowly over a period of time as the protocol matures.

The allocation, based on order from highest to lowest, is as follows:

- Audience: 55% (1.100.000.000 tokens)

- Team: 25% (500.000.000 tokens)

- Investors: 13% (260.000.000 tokens)

- Future hires: 5% (100.000.000 tokens)

- Advisors: 2% (40.000.000 tokens)

Also, when it comes to the team and investor acquisition, the team, investor and advisor tokens that have been allocated so far are acquired and will be released on a 4-year timeline for the team and a 2-year timeline for the investors and consultants, with an agreed sale schedule on top of the acquisition schedule. Purchased tokens will be released monthly on a pro-rata basis.

Where to buy SundaeSwap?

Cryptocurrency investors and traders will be able to buy the SundaeSwap token when the DEX is released across the ISO or exchange it for it on DEX. Alternatively, users also have the opportunity to provide liquidity to the protocol as a means of gaining access to SUNDAE tokens on the SundaeSwap mainnet.

Reasons to buy SundaeSwap

SundaeSwap uses a solid launch mechanism known as the Initial Offering of Participation (ISO) as a means of token distribution. What this means is that users will receive SUNDAE tokens when betting on the pools.

Here are the top three reasons why you want to buy SundaeSwap:

- SundaeSwap Staking Potential: This is the main reason why it is a great way to earn additional rewards.

- It's an early DEX project: SundaeSwap has clearly not reached its peak in terms of popularity. Therefore, over time, the value of the SUNDAE token can increase to a much higher point than at launch.

- Platform revenue generation: SUNDAE token holders can receive a share of platform revenue depending on the number of tokens they hold, and governance rights are also granted to SUNDAE token holders once the voting mechanism is available , where they can decide the future of the protocol together, while still following the law in voting these changes.

How to use SundaeSwap

Step 1: Navigate to the official SundaeSwap website – after which you can hit “Enter App” to access pretty much everything you are looking for.

From the home menu, you have access to numerous options.

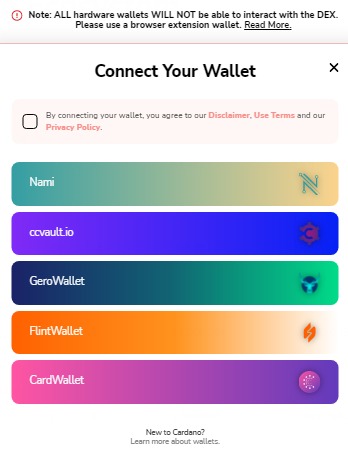

Step 2: In the upper right corner of the screen, click on “Connect Wallet” and connect the cryptocurrency wallet that you will use as a means of carrying out all your exchanges and transactions within the platform.

For now, you can collect Nami, ccvault.io, GeroWallet, FlintWallet, and CardWallet.

From the home screen you have access to some common trading pairs like SUNDAE/ADA for example and you have access to exchange the token in question or provide liquidity.

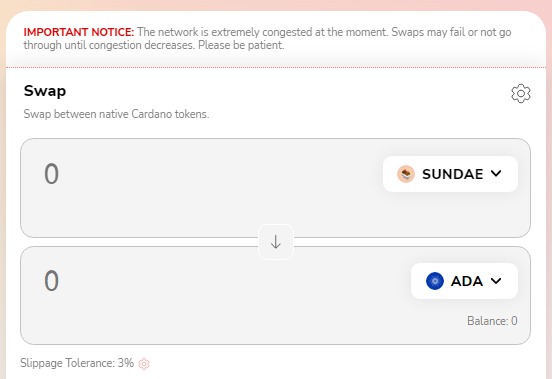

Step 3: Decide if you want to exchange the token in question or provide liquidity.

Step 3.1: Swap the token – Here, you will need to click on Swap SUNDE/ADA, for example, and in the following menu, decide how many tokens you want to use for your exchange.

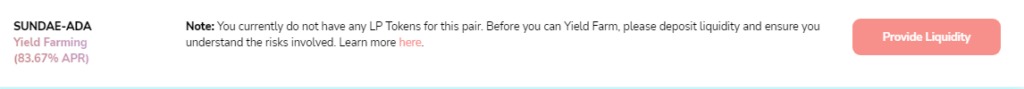

Step 3.2: Provide liquidity by connecting your wallet and contributing tokens.

Please note that the APR percentage will differ based on the pool chosen here. For example, at the time of writing, the SUNDAE-ADA Yield Farming pool has an average APR of 83,67%.

Keep in mind that if you don't have any LP Token for this pair before you can Yield Farm, make sure you deposit liquidity and make sure you understand all the risks involved in doing so. This is how you can participate in staking SundaeSwap.

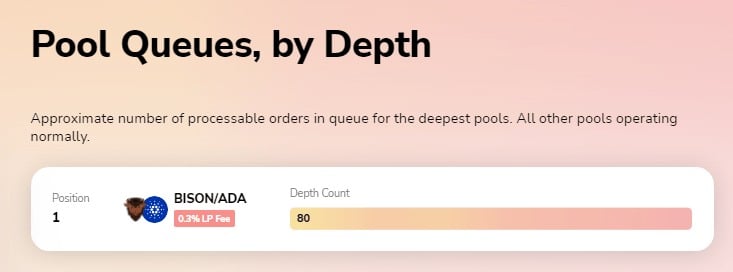

Step 4: Check the queues – SundaeSwap allows you to have a detailed view of the queues where you can see an approximate number of processable orders queued for the deeper pools. Note that all other pools are operating normally, which is not listed here.

Conclusion

SundaeSwap is a decentralized exchange protocol built on top of the Cardano Network, which allows native token and ADA exchanges for anyone. With this protocol, users can trade, bet, borrow, borrow and do much more in a decentralized way. It has a simple user interface and is easy to understand and use by just about anyone.