Shield is a decentralized derivatives trading protocol that sits on a fully non-cooperative gaming network and is comprised of traders, brokers, liquidators, public LP pool and private LP pool.

In this article, we will discuss:

What is Shield (SLD)?

Shield is a decentralized derivatives trading protocol that sits on a fully non-cooperative gaming network and is comprised of traders, brokers, liquidators, public LP pool and private LP pool.

The platform believes that blockchain technology and the non-cooperative gaming system will be the future of the derivatives protocol and will soon be adopted by the global derivatives trading markets.

How Does Shield (SLD) Work?

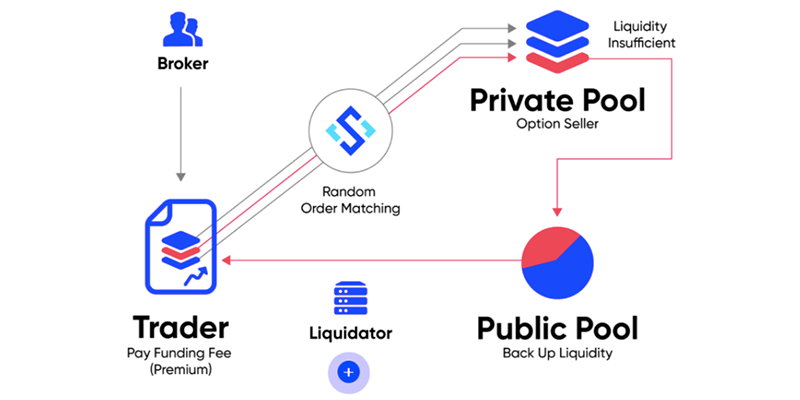

Every role in the Shield network is designed to benefit the participants and the entire network, and while the value creators work for their specific interests, they all contribute to the stability and security of the platform, which, in the end, benefits everyone.

Here are the roles that interested participants can play in the Shield network.

Traders

They open long or short positions for both hedging and speculative purposes, and are equipped with the ability to adjust their risk exposure based on current market conditions through Shield's fixed rate funding cost approach.

They pay trading fees and financing fees for their business transactions and act as “buyers” for the platform.

Public pool

They provide liquidity to the Shield's public pool and focus on participants in retail liquidity mining and profit from the Financing Fee percentage and token incentives. The public pool also acts as the senior tranche, which provides participants with limited exposure to market risk and only outperforms the liquidated positions in the platform's private pool.

This pool is used when the entire private pool reaches insufficient liquidity or the net provider's order margin is inadequate. Platform users can earn LP rewards on SLDs by participating in liquidity mining.

Private pool

They provide liquidity to the platform's private pool and are focused on taking orders and trading your net position through various hedging strategies. A large percentage of the LP2 or private pool are institutions and derive their profits from the market making strategy and funding fee accounts.

The people who make up this pool contribute liquidity to Shield's private pool, using their skills and abilities in professional market-making capabilities.

For their contributions they get a liquidity bonus in the form of SLD and trader financing fee.

Brokers

They can earn up to 40% commission for bringing in new traders who finally traded on the Shield network. The platform's “Broker Campaign” commission program encourages brokers to introduce and bring new traders to the Shield Network.

Liquidators

Your task is to trigger a settlement contract when a funding rate or liquidity margin account reaches an insufficient balance. Liquidators receive 150% of gas expenses as arbitrage rewards.

perpetual options

Perpetual Options is the platform-derived tool that presents long-term chain options and eliminates the big risks involved in rollover options.

Here are the main features of Perpetual Shield Options:

- Easy Accessibility: A stable internet connection and an encrypted wallet are required to get started

- 24-hour chain trading in a no-custody, no-trust environment

- Provides strong liquidity through dual liquidity pool using a peer-to-peer model

- The daily financing fee comes from the maximum trading loss

- Referrals are encouraged through a decentralized broker

- Gas tax and competition-based incentives are provided to external settlers

-

Eliminates KYC email and registration requirements

How to start trading with perpetual options?

- Step 1: Go to the Shield website and click on the 'Start Trading' button.

- Step 2: Connect the MetaMask wallet and switch to Binance Smart Chain or BSC network.

- Step 3: Enter the financing amount, click the 'Deposit' button and sign the transaction in the wallet.

- Step 4: Choose a preferred trading pair, select between a long or short order, enter the value and click the 'Open' button.

- Step 5: Open the long position, carefully check the locked financing rate and check the order.

- Step 6: The process has been completed and the status of the order can now be checked.

Perpetual Options Reminders

The Perpetual Option Agreement is equipped with a finance fee mechanism. In the event of an unfavorable price movement in the market, participants would not be affected by any loss and may maintain an open position as long as they maintain sufficient funds in their prepaid funding rate.

If a participant's funding fee balance has not reached the rates required to maintain an open position,

liquidation will be activated, closing your position as a result.

Steps on how to provide liquidity in a public pool

- Step 1: Visit the Shield website and connect the wallet.

- Step 2: Choose your preferred liquidity, enter the amount of assets, review the details and click the 'Confirm' button to complete the transaction.

- Step 3: After receiving the reTOKEN, which corresponds to the deposited token, check the participation in the pool.

- Step 4: Go to the Shield MINING page, enter reTOKEN and press the 'lock' button.

- Step 5: SLD real-time rewards can now be verified.

Provision of liquidity in a private pool

Shield's private pool is designed specifically for professionals with a greater appetite for risk and has long experience and in-depth knowledge of hedging positions.

Participants must provide USDT, USDC and DAI and in return will receive SLD tokens based on the transaction fee of their order.

This pool comes with a higher risk but offers significant rewards to investors, and the benefits they will receive will come in the form of SLD tokens.

Here's a quick look at how rewards are calculated in this pool:

- SLD value = Transaction fee of investor order * 15% 0,05 SLD.

How to Earn as a Shields Broker

The Shield network uses a decentralized brokerage system that encourages brokers to provide education and consulting services to traders they bring to the network in exchange for incentives.

Referral and affiliation rewards will all be integrated, meaning this mechanism will virtually transform brokerage into a trustless process; As a result, Shield can finally solve the transparency issues that often arise in the non-profit brokerage system. blockchain.

The platform uses a competition-based 'ranking' system to provide rewards on referrals made by brokers. Shield divides brokers into three categories, and each category will be based on their performance and will provide different levels of commission.

Top 20 performers will be identified as Tier A, top 21-50 as Tier B, top 51-100 as Tier C; and the remaining brokers out of the top 100 brokers will be classified as Level D.

For the commission rate, tiers A and B will have a 40% cut, and 30% for tier C. When it comes to distributing reward groups, tier A will have 60% commission, tier B, 40 % and level C - 10%

SLD token

SLD Token serves as the Shield platform's utility token and is intended to encourage the autonomous decentralized organization of the platform or DAO. The platform distributes 100% of the revenue generated from trading fees to value creators or everyone involved in maintaining the decentralized nature of the network.

What is the future of Shield DAO, should I invest in the SLD token?

Shield DAO is a professionally built risk-free derivatives trading platform with perpetual futures. The platform's protocol allows transactions to take place in the chain and is completely decentralized and unreliable. This is a project that only focuses on a smartcontract-derived matrix, although it can create special features, it is difficult to attract users.

Having said that, before making any investments, do your research, investing in cryptocurrencies is highly risky and speculative, and this article is not a writer's recommendation to invest in cryptocurrencies.

Where to buy the SLD token?

- Uniswap (V3)

Conclusion

Shield's innovative rewards system and its full use of blockchain technology give traders, brokers, liquidators and pools the privilege of earning in a safe and untrustworthy environment that will allow them to finally grow their wealth even further and seize new opportunities.