Built on top of the state-of-the-art NEAR protocol, Ref Finance is the gateway to the NEAR ecosystem through its AMM DEX, which provides liquidity and swap capabilities. Additionally, Ref utilizes the trustless Rainbow Bridge, which seamlessly connects Ethereum-based assets to NEAR and vice versa, allowing a variety of DeFi users to access lower fees and faster transaction speeds.

In this article, we will discuss:

What is Ref Finance (REF)?

Ref Finance is a DeFi marketplace for native NEAR tokens that leverages the power of NEAR's low fees, ultra-fast finality, and WebAssembly-based runtime. The platform allows users to trade tokens using its Automated Market Maker exchange, stake LP token on farms and provide liquidity to the system.

One of REF Finance's main goals is to partner with various NEAR projects and help them create market peers on their platform and provide them with a better market presence. The platform has already initiated token exchanges and pooled tokens with NEAR-based projects to form markets with active liquidity.

How does Ref Finance (REF) work?

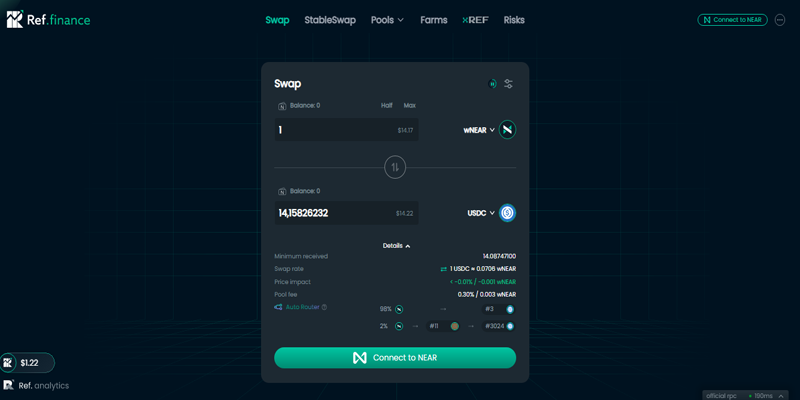

- One AMM Dex: Ref Finance currently allows assets in NEAR to trade without permission and automatically through liquidity pools managed by a smart contract.

- Liquidity Pools: LPs can contribute liquidity to liquidity pools in Ref Finance and earn a percentage of trading fees. Ref Finance offered several pools with different trading fees. Create your own pools: LPs can also create new pools for any preferred token pairs and charge different fee levels: 0,15%, 0,25% or 0,55%.

- Agriculture: Ref Finance helps users earn REF tokens by staking their liquidity provider (LP) tokens.

- Staking: Users can also bet on earned REF tokens to earn more and more REF over time.

- Decentralized Governance through Ref DAO: In the long term, the generation, distribution and management of tokens and other community proposals will be governed by the REF holders.

Reference funding mechanism

Participants can trade or become a liquidity provider (or both) on the platform by depositing an equivalent of each underlying token in exchange for LP tokens, also called “pool tokens”. The liquidity pools of the Uniswap may be more popular than Ref Finance's for now, but that doesn't mean Ref's services are inferior in any way.

Ref Finance's advantage over Uniswap is that its smart contract contains all pairs of liquidity pools, which comprise reserves of two or three NEP-141 tokens, such as NEAR's ERC-20 tokens.

Ref Finance DAO

Ref Finance's DAO or “ref.-finance.sputnik-dao.near” currently uses SputnikDAO, a DAO hub powered by NEAR, to streamline its operations. In addition to having voting power, DAO members are also authorized to participate in project management, product testing, product strategy, and even in matters related to public relations and communication.

Members are also reminded that they must exercise independent voting rights and not just act in the vested interests of other parties.

DAO functions

- Board – Board members are the only ones who can create proposals on the platform and have the authority to approve or reject them through voting.

- Community – Community members may not have the authority to submit proposals, but for most proposals, council members entrust voting rights to the community.

Ref Finance: Reference Functions

Traders, stakers, liquidity providers and developers are the main roles that a platform participant can choose when joining Ref Finance.

- Merchants – Responsible for exchanging NEP-141 tokens

- Gamblers – Receive “pro-rata shares” of revenue from the shared protocol. Pro-rata is a method used to assign a proportionate amount of revenue or losses to each side based on their percentages of ownership.

- Liquidity Providers – They are rewarded for providing NEP-141 tokens to liquidity pools.

- Developers – Help participants better interact with trading interfaces, trading strategies, tokens and other crucial components of the platform.

Merchants

A 'trader' in Ref Finance is actually a broad term as there are four main types of traders who execute different trading strategies on the platform.

- 1. Speculators – A speculator, as their name suggests, trades purely on the basis of speculation, as well as a “monkey” approach, which involves buying a token from a newly launched project without proper research. data-driven strategies, such as fundamental and technical analysis, that provide better results than imitating new designs.

- 2. Dapp Users – Dapp users buy tokens to use other NEAR-based apps that focus on NFTs, gaming, finance and more.

- 3. Smart Contracts – They are designed to trade by applying trade functionality in products like custom scripts and DEX aggregators.

- 4. High Frequency Bots – High Frequency bots execute various trading strategies which include long/short and market neutral arbitrage strategies.

gamblers

- 1. Long-Term Stakeholders – Long-term stakeholders focus on holding a protocol token, participating in governance, and any platform ventures that ensure earnings stability.

- 2. Short Term Stakers – Short term stakers, also called “infra-strategy stakers”, focus on limited period staking. They focus on maximizing their returns until their REF tokens need to be used for other purposes or need to be sold.

- 3. Voting-Only Stakers – The main task of Voting-Only stakers is to influence the path of specific proposals by providing their votes on them.

Liquidity Provider (LP)

- 1. Passive Liquidity Provider – Passive liquidity providers are REF token holders who passively invest to earn trading fees and do not engage in active ventures such as monitoring their positions and divergence losses.

- 2. Sophisticated Liquidity Provider – Sophisticated LPs take on active roles such as market making, monitoring your positions and divergence loss, and developing custom tools for trading.

- 3. Token Projects – Yes, sometimes token projects can act as LPs creating a liquidity pool for their own tokens to initiate liquidity.

Developers

Developers can use Ref Finance's advanced platform to run UX/UI experiments, liquidity aggregation, DeFi dashboard projects, yield aggregation, and monitor data and analytics.

REF token

The REF cryptocurrency is the platform’s governance token with an offering of 100 million and uses a protocol revenue-sharing model to provide rewards to holders. The token can be used for pooling, agriculture, governance and even speculation to earn profits while protecting the entire ecosystem.

Ref Finance aspires to be a 100% community-governed platform in the near future, and once accomplished, REF will play a central role in the ecosystem.

Price Forecast for Ref Finance Cryptocurrency

According to our technical analysis on previous REF price data, in 2022 Ref Finance price is expected to reach a minimum level of $1,46. The REF price can reach a maximum level of $1,76 with the average trading price of $1,50. The Ref Finance price is forecast to reach a low of $2,12 in 2023. The Ref Finance price could reach a high of $2,57 with the average price of $2,18 throughout 2023.

As per forecast price and technical analysis, in 2024 Ref Finance price is expected to reach a minimum level of $3,05. The REF price can reach a high level of $3,71 with the average trading price of $3,14. The price of 1 Ref Finance is expected to reach a low of $4,32 in 2025. The REF price could reach a high of $5,43 with the average price of $4,47 throughout 2025.

Where to buy REF token?

REF cryptocurrency can be traded on the following exchanges:

- Gate.io

- MEXC

- jubi

Conclusion

There is still a long way to go for Ref Finance. The project is still very early. DeFi Legos will be built around the Ref AMM core to enable trading, swapping, synthetic asset issuance, tranches, and more. With that said, Ref Finance is worth watching closely. Ref Finance is a service, not only for cryptocurrency enthusiasts, but also for NEAR projects that want to show a stronger presence for their tokens. And by creating a platform for individuals and projects, it can potentially create huge demand and position itself as a major player in the industry. blockchain highly competitive.