Position Exchange is a Decentralized Trading Protocol operating on the Binance Smart Chain (BSC), which allows traders, liquidity providers and developers to participate in an open financial market with no barriers to entry. No authorization is required to use the open source position exchange protocol.

In this article, we will discuss:

What is Position Exchange?

Position Exchange is a decentralized cryptocurrency platform with a complete ecosystem aimed at bridging the gap between people and cryptocurrencies and enhancing the DeFi experience.

The protocol is fully owned and governed by its community and offers a wide range of DeFi products for all types of users in an open, transparent and trustless system where everything runs in a daisy chain. The platform is designed to offer all the advantages of Decentralized Finance, while bringing the experience and traditional tools of Centralized Finance.

Users can trade crypto derivatives, generate passive income through farming and staking, invest and lend, immerse themselves in the NFT world, participate in governance and community activities in a truly decentralized system. Position Exchange with its large ecosystem and long-term vision aims to be the decentralized cryptocurrency platform of choice

Position Exchange is powered by the POSI token, its native utility cryptocurrency that serves as the backbone of its ecosystem. Holders can benefit from multiple advantages and use POSI in other functionalities developed by the Platform.

What is Position Exchange Token (POSI)?

POSI is Position Exchange's native BEP20 token that powers its ecosystem. Unlike most recent tokens created by other exchanges primarily for crowdfunding purposes and to reduce trading fees, POSI comes with a different and unique approach. All protocol fees and revenues will be distributed back to all POSI holders by a fully on-chain mechanism called Buy-Back and Burn. This would mean that just by holding the POSI you are a stakeholder and could receive a share of the revenue.

The total supply of POSI tokens has been fixed at 100.000.000 tokens, starting with an issuance fee of 5 POSI per block.

Use cases:

- Holders of POSI tokens can generate passive income by staking their tokens in staking pools and receive rewards in return – See Staking section.

- POSI token can holders can farm LP tokens – See Farming section

- POSI token can be used to launch NFTs – See NFTs section.

- POSI token holders can participate in the governance of the platform by proposing and voting on changes.

- POSI token holders will share a 1% transaction fee while holding the tokens.

- Holders of POSI tokens can receive discounts on Trading Protocol fees

Main features of the Position Exchange platform

Investing: Let Your Crypto Work!

POSI holders can stake the tokens in Staking Pools to receive rewards and transaction fees. Staking indirectly serves to support the system.

Build: Easy and fast on-chain API creation!

The Position Exchange protocol is a staple of the DeFi infrastructure, an original permissionless development platform, offering a flexible and versatile vAMM, providing developers with great flexibility and customization.

Trading: Take your trading to the next level!

Trade on-chain derivatives with high leverage, low fees, low slippage and gas costs. Position Exchange allows efficient trading at the best available price. Easily exchange ERC-20 tokens without permission.

Products

Derivatives Trading Protocol

Decentralized cryptocurrency exchanges offer many advantages, including anonymity and peer-to-peer transactions. But many are complex to use and hampered by low transaction volumes. As we strive for simplification and simplicity these are often bound to happen to core platforms, which do not have a proven issue, and customers with problematic registration processes.

We provide a solution for everything, with products and a choice of set of great features, and we aim to become a centralized exchange and trading platform.

Position Exchange is a Decentralized Trading Protocol, powered by a vAMM and operating entirely on the BSC. The protocol offers easy and affordable derivatives trading where users can trade fully on-chain and trustless crypto derivatives products with high security and privacy.

Unlike traditional derivatives trading, in on-chain trading there is no need for a broker. Instead, settlement occurs automatically on-chain, where the terms of the smart contract are met. The intersection of DeFi and derivatives is a game-changer, yet another borderless, low-barrier financial instrument for the world.

The platform is designed to offer all the advantages of Decentralized Finance, while bringing the experience and traditional tools of Centralized Finance. Not to mention high leverage, low slippage and low costs like limit orders, all while facing the liquidity problem using vAMM.

Position Bonds

What is a Bond?

A bond is a fixed income instrument that represents a loan made by an investor to a borrower (usually corporate or government). A bond can be thought of as an IOU between the lender and the borrower that includes the details of the loan and its payments. Bonds are used by companies, municipalities, states and sovereign governments to finance projects and operations. Bondholders are the debt holders, or creditors, of the issuer.

Position titles will work similarly to traditional titles, but will run entirely in blockchain and will be stackable. How is that? Check this out below.

The story behind Position Bonds?

Position Exchange is a decentralized cryptocurrency platform aiming to bring different DeFi features into one big project aiming to become a hub for decentralized crypto trading and exchange. As we are focusing on Derivative Products, Bonds are a great financial instrument that has a stable and predictable income stream and strong market demand.

Looking at current DeFi products and projects, there are plenty of Loan Protocols that provide Auto Pools where lenders and borrowers interact. This design is efficient in ensuring that there is always available liquidity and borrowing funds. However, the return on investment remains very low.

Bonds follow a similar format, but provide higher/stable returns and target a larger market. Users can range from individuals to organizations or companies. Bonds also have broader use cases and purposes, they can be exchanged, used for governance, financing, and more. It is a highly useful financial instrument and integrating it into Blockchain is game-breaking!

Position Exchange is launching its first Derivative Product, the fully on-chain and actionable securities. Users can buy bonds and bet in the Bond Pool with a stable and fixed APR for a set duration and when the bonds mature, the issuer will pay the investment plus interest. The bonds will be asset-backed as collateral and will be locked into smart contracts. Payment to the investor when the securities reach maturity will be secured and guaranteed by the Position Exchange.

They can also exchange bonds on the “Position Bond Exchange” and even issue their own. Individuals, companies, projects can lock their assets (tokens, coins, NFT or even real estate) as collateral and issue Position Securities to lend investors money.

Position Exchange is creating an all-in-one resource, providing financial solutions for DeFi users and introducing securities to the blockchain.

Position Exchange

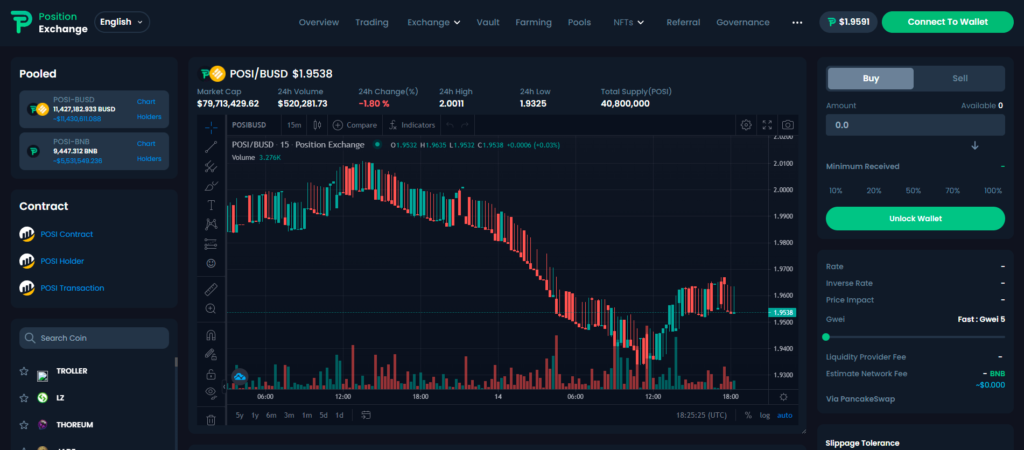

Position Exchange Exchange is using a Pancakeswap router, which is an Automated Market Maker (AMM). The team will develop and build the Decentralized Exchange platform itself in the coming months.

The Exchange offers several features that support decentralized trading:

Exchange/Trading

The exchange allows users to trade without the need to go through a Centralized Exchange. Everything you do in Position Trading is routed directly through your own wallet – no need to entrust your coins to someone else!

Liquidity Pools

Chips can only be exchanged on the exchange if there is sufficient liquidity for those chips. If no one has added a lot of liquidity to the chips or chips you want to trade, it will be difficult, expensive, or impossible to do so.

Providing liquidity will give you exchange tokens, which will earn you rewards in the form of exchange fees for ensuring there is always liquidity for the exchange to use.

income agriculture

Cash farming allows users who are providing liquidity to earn POSI rewards by closing their LP chips in a smart contract. The incentive is to balance the risk of impermanent loss that comes along with blocking your liquidity.

Currently, the Stock Exchange offers:

- classic swap

- ExchangePro

Exchange Pro offers a broader view of trading and provides users with the necessary information regarding Token Trading. It will serve as the basis of the Decentralized Exchange itself.

Yield Farms

Yield Farms allow users to earn POSI while supporting the exchange of positions by betting on LP chips.

The Farm Yield APR calculation includes both rewards obtained through providing liquidity and rewards obtained through betting chips at the Farm.

Previously, rewards earned by LP Token holders generated from exchange fees were not included in Farm RAP calculations. TPA calculations now include these rewards, and better reflect the expected TPA for Farm pairs.

Staking

Staking allows users to earn POSI simply by depositing their chips into Staking bets. It is much simpler than Yield Farms because, unlike farms, you only need to bet one chip to start winning: usually the POSI.

The process is quite quick and simple:

- Go to Pools tab

- Select the Pool you want to bet on

- Click Approve POSI

- Enter the amount you would like to bet

- Click Confirm and Enjoy your daily earnings!

NFTs

Position Exchange is building a new NFT Protocol and introducing Crypto NFTs as a new feature. Users can launch NFTs with unique features and different rarities (by depositing POSI chips) and then bet on NFT Pools to generate rewards. Issue, trade NFTs and participate in auctions!

What is the NFT stake?

In a regular staking pool, users deposit chips into a contract and are rewarded with the same or a different chip in the form of rewards.

An NFT staking pool is different and somewhat similar to Agricultural Pools because, as a user, you:

- deposits POSI tokens in a contract.

- Get rewarded with NFT cards with different rarities and characteristics (The better your NFT, the higher your mining power)

- Stack the NFT cards in the NFT Pool.

- Earn the POSI.

vaults

Position Exchange is bringing Vaults to its platform, a feature that allows users to stake their unique crypto assets and generate rewards while self-composing through a very simple process.

What are Position Trading Vaults?

Vaults are unique features brought by Position Exchange, allowing users to stake their tokens and generate rewards. By depositing tokens in the vaults, users can save time and network fees, always automatically composing every 7 hours. Imagine buying POSI, getting LP tokens, betting on LP tokens and increasing your winnings all in one go? Well, safes can do it for you in a single click.

Currently BUSD Vaults is available to users. POSI, BNB and more vaults will be available soon!

Where to buy Position Exchange Coin (POSI) token?

POSI cryptocurrency can be bought on several major cryptocurrency exchanges, some of the biggest ones are: PancakeSwap (v2), MEXC Global and Gate.io.

Position Token (POSI) 2025 Price Prediction

According to our crypto price prediction index, in 2025 POSI should cross an average price level of $10.022. The minimum expected value of the Position Token price at the end of the current year should be $9.254. Furthermore, POSI can reach a maximum price level of $10.214.

Position Token (POSI) 2030 Price Prediction

The Position Token price is predicted to reach the lowest possible level of $8.870 in 2030. According to our crypto price prediction index, the POSI price could reach a maximum possible level of $16.358, with the predicted average price of $12.326.

Conclusion

Although Position Exchange uses the Pancakeswap router, the platform has many features that make it a great choice within the DeFi space. The platform is still under development but has many features that can generate income for investors in the DeFi universe.