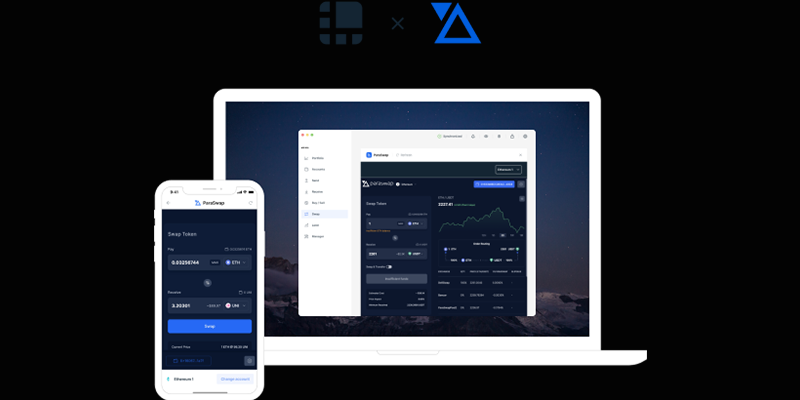

ParaSwap is an innovative and competitive Decentralized Exchange (DEX) aggregator. Using a combination of features, ParaSwap aims to optimize user experience with decentralized finance (DeFi) protocols, branding itself as a solution for DeFi liquidity.

ParaSwap aggregates prices and data feeds for many major decentralized exchanges to discover and offer the best price for users. This is in addition to routing through the ParaSwapPool, offering even better exchange rates. Furthermore, ParaSwap acts as an intermediary layer between DeFi liquidity protocols and users. ParaSwap aims to facilitate faster and fairer trading of Ethereum-based tokens (ERC-20).

In this article, we will discuss:

What is ParaSwap?

ParaSwap is a decentralized middleware aggregator in blockchain Ethereum offering the best prices on several DEXs. On ParaSwap, users can see a useful summary of the transactions they have made, including the approximate cost, price impact, and minimum tokens received. Routing details are also displayed to help users understand the path of their tokens and avoid confusion.

In principle, ParaSwap serves as an intermediary between DeFi users and DeFi services. It compares the liquidity of 20+ decentralized exchanges and brings all functions into a single portal for maximum user convenience.

Several large investors support the ParaSwap protocol. During its recent seed funding round, ParaSwap gained backing from established companies such as CoinFund, Blockchain Capital and Arrington XRP Capital. ParaSwap's goal is to become the preferred DEX aggregator on Ethereum and enable the fastest trades with the best fees. In addition to Ethereum, ParaSwap also supports Polygon, Avalanche and Binance Smart Chain.

How does ParaSwap work?

ParaSwap offers its end users an optimal route and an effective price through a series of built-in routing mechanisms. It helps users save time and effort by making price comparison easier and optimizing trading strategies.

When a user accesses the exchange, ParaSwap identifies the best rate with the help of a price aggregator that retrieves off-chain prices. It then executes the exchange using a smart contract to deposit the fee into a wallet. This process may involve splitting a single order into multiple exchanges if that is the most cost-effective method.

See how trading takes place on ParaSwap:

- The user selects the number of tokens he wants to trade.

- ParaSwap determines the best trade rate on all supported DEXs.

- ParaSwap provides the user with detailed information about all trade routes.

- The user can select the most suitable route and initiate a transaction.

- The exchange is then performed and the user receives the corresponding tokens.

Key Features of ParaSwap

ToSwapPool

DEX aggregators do not typically hold or store liquidity of their own. On the other hand, ParaSwapPool allows users to access ParaSwap's private market makers pool as their source of decentralized financial liquidity (DeFi), creating opportunities for efficient path and transaction optimization.

ParaSwap ensures that all relevant trades are routed through ParaSwapPool for the best rates. ParaSwapPool is a pool of professional liquidity investors, accessible through the RFQ (request for quote) system. However, ParaSwap aims to create a more decentralized and affordable alternative in the future.

multipath

MultiPath is the pathing protocol developed by ParaSwap. Its functions include discovering various “paths” or routes of exchange of tokens during a trade. MultiPath can also interface with automated market makers (AMMs) and DeFi lending platforms. With MultiPath, ParaSwap users' transactions can be seamlessly routed through major DeFi protocols such as Compound and Aave.

The MultiPath protocol can split transactions across multiple exchanges and facilitate intermediate tokens to negotiate better rates when needed. If there is no direct trading pair when trading and exchanging tokens, MultiPath can process the transaction on various automated market makers (AMMs), DEXs and DeFi liquidity protocols. In addition, Ethereum gas fees and fluctuating price variables are also taken into account during trading. MultiPath can also facilitate indirect trade routes with two or more hops between protocols for a smoother user experience.

exchange fees

A certain amount of computing power is required to process transaction requests on the Ethereum blockchain. This power is referred to as "gas". Gas fees can fluctuate considerably depending on the size of the transaction (not the amount) and the amount of activity taking place on the network. ParaSwap does not charge any fees for its services. Instead, ParaSwap-integrated services receive a commission for all facilitated exchanges, and ParaSwap receives 15% of this commission. In addition, ParaSwap receives a small commission through a revenue-sharing agreement for decentralized applications (DApps) that use the ParaSwap API.

ParaSwap optimizes gas fees when users place a trade. Although using ParaSwap is free, users still need to pay the Ethereum network fee as every trade on ParaSwap.io is settled on Ethereum. When gas costs are low, ParaSwap also allows tokenization in the form of GST2 GasTokens. These tokens are then used with ParaSwap trades to reduce and optimize gas fees on Ethereum during periods of high network activity.

Positive slip cover

Cryptocurrencies operate in a free market where asset prices can be volatile. While one is waiting for confirmation of its transaction, other transactions on the network can increase or decrease the price of a token. This phenomenon is known as “slipping”. ParaSwap has implemented several features to protect against slippage. These features include a “minimum received” amount, as well as guaranteed token prices for a set period using ParaSwapPool.

For ParaSwap v3 smart contracts, the rate model around slippage has been slightly tweaked. In cases of positive slippage, users may receive more tokens than usual for the price paid. However, apps are not required to provide users with positive slippage value, with some services retaining any profit made.

As a community-driven project, ParaSwap contracts are set to return 50% of the positive slippage to the platform's growth, with the other half going back to its users. As an example, when trading ETH with DAI, this arrangement means that the user may receive some more DAI tokens than originally declared.

PSP Token

ParaSwap's native/governance token, PSP is used to increase the decentralization and effectiveness of the protocol. About 20.000 users have just received the ParaSwap token airdrop, worth over $240 million at press time. In a retroactive airdrop, ParaSwap allocated 150 million PSP tokens, or 7,5% of the total supply, to active users of the protocol.

Currently, the PSP token has two use cases:

Governance: PSP holders have governance rights over the ParaSwap protocol through the ParaSwap DAO.

Staking: Users can stake their PSP tokens and receive an Automatic Compound Annual Percentage Yield (APY).

Is ParaSwap (PSP) a good investment?

The price of ParaSwap is predicted to reach $0,95 by the end of 2021 and possibly more than $4,00 within the next five years. According to experts and business analysts, ParaSwap could reach $28,33 by 2030.

As the scarcity of coins tends to drive up prices, the value of ParaSwap is expected to continue increasing. However, users are advised to examine their personal investment goals and closely monitor the performance of the PSP token before investing in it.

Price Forecast For Swap (PSP)

The price of ParaSwap is predicted to reach a high level of $0.1784 throughout 2022.

As early as 2023 According to our crypto price prediction index, ParaSwap (PSP) may reach a maximum level of $0.4414, with the average trading price of $0.3283.

In 2025 according to our crypto price prediction index, PSP is expected to cross an average price level of $0.532. The minimum expected value of the ParaSwap price at the end of the current year should be $0.4914. Furthermore, PSP can reach a maximum price level of $0.542.

Where to buy PSP token?

PSP cryptocurrency can be traded on the following exchanges:

- bybit

- Gate.io

- MEXC

- XT.COM

Conclusion

The ParaSwap platform is designed for seamless integration into developers' DApps. By implementing efficient protocols for developers and merchants, ParaSwap has secured a privileged position in the DeFi market.