DODO is a decentralized finance (DeFi) protocol that functions as a low-slip on-chain liquidity provider based on Ethereum and Binance Smart Chain (BSC) and powered by an innovative market maker algorithm called Proactive Market Maker (PMM).

In this article, we will discuss:

What is DODO?

DODO is a Chinese decentralized finance (DeFi) protocol and on-chain liquidity provider, where its unique Proactive Market Maker (PMM) algorithm seeks to provide better liquidity and price stability than Automated Market Makers (AMM) .

The PMM pricing engine, which mimics human transactions, uses oracles to gather highly accurate market prices for assets. Thus, it provides sufficient liquidity near these prices seeking to stabilize liquidity providers (LP) portfolios, decrease price slippage and avoid impermanent losses by allowing arbitrage trades as a reward.

DODO also caters to new cryptocurrency projects with a free ICO listing through its DODO Initial Offering (IDO), which requires issuers to deposit only their own tokens.

The DODO smart contract operates as an ERC20 token on the Ethereum network.

How Does DODO Work?

DODO positions itself as one of the most competitive liquidity providers, offering very low transaction rates and little price slippage through the PMM algorithm, initially created in April 2020.

The team claims that its PMM algorithm offers higher prices than its AMM competitor. Uniswap, due to a flat price curve.

The PMM collects funds close to the market price to establish liquidity, falling rapidly as the price moves away from the market price. DODO automatically adjusts the market price to attract arbitrage, helping to keep the portfolio of liquidity providers stable.

This ensures more favorable pricing, greater use of funds and decreased price slippage, unique risk exposure and impermanent losses.

For traders, DODO offers sufficient liquidity, comparable to centralized brokerages (CEX), which can be used natively in smart contracts for on-chain transactions such as settlements and auctions. Arbitrators can also take advantage of the difference in pricing between DODO and other brokers.

There is no minimum deposit requirement for liquidity providers, nor are there restrictions on the type of asset they will offer. LPs can create their own trading pairs, deposit their own tokens to negate price risk and also collect a portion of DODO transaction fees as a reward.

DODO also attracts new cryptocurrency projects with free listings with DODO Initial Offer (IDO). Unlike AMM protocols, DODO does not require token quotes, and IDO projects only need to deposit their own tokens into the liquidity pool, in order for the PMM to create its own liquidity depth. To start an IDO, the project only needs to set the price of the oracle in a constant. Liquidity improves by depositing more quote tokens.

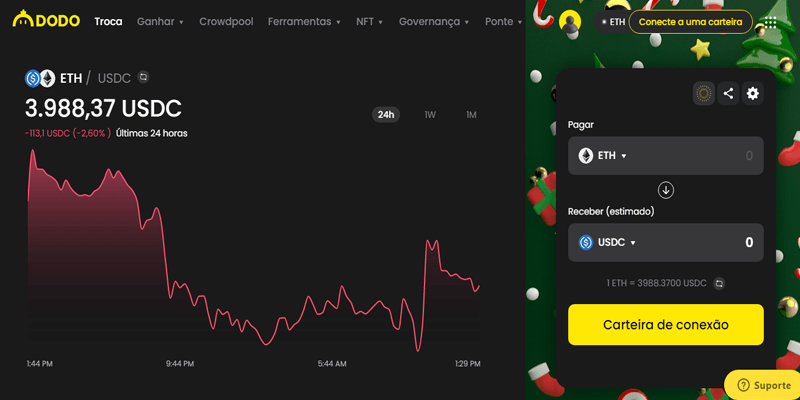

DODO DEX

According to the documentation, the DODO V2 product suite consists of a SmartTrade, Crowdpool / IDO, pools and mining aggregation and trading service which includes liquidity mining, commercial mining and combined mining. The platform supports many wallet applications including MetaMask, Coinbase, WalletConnect and Portis.

In addition to the standard DEX products, DODO also has some unique features that include the DODO vending machine, DODO NFT Vault and DODO private pools.

At the heart of the protocol is its PMM algorithm that provides the market-making model.

PMM

DODO's Proactive Market Maker (PMM) algorithm is developed entirely in-house by the DODO team, iterating through the Automated Market Makers (AMMs) project to improve capital efficiency, reduce impermanent loss and minimize slippage for traders.

According to the documentation, the PMM is an elegant, integrated generalization of order book trading. The PMM pricing engine, which mimics human trading, uses oracles to gather highly accurate market prices for assets. AMM-based DEXs use a simple fixed curve to determine the current price based on the current value of each asset held. PMM proactively adjusts parameters such as asset index and curve slope in anticipation of market conditions, resulting in DODO pools that are adaptable and flexible for all types of use cases.

This allows the protocol to provide enough liquidity close to market prices to stabilize liquidity providers (LP) portfolios, decrease price slippage and negate impermanent losses, allowing arbitrage trading as a reward.

SmartTrade: Trading and Aggregation Engine

SmartTrade is a decentralized liquidity aggregation service that routes and compares multiple liquidity sources to quote the optimal swap rate between any two tokens. This feature intelligently finds the best order routing from aggregate liquidity sources to offer traders the best prices.

Through this routing algorithm, DODO allows the negotiation between two arbitrary tokens in Ethereum and Binance Smart Chain (BSC). In DODO, for the same token asset, there are multiple liquidity pools with different price curves and parameters configured and designed by users to meet their specific market-making needs. DODO SmartTrade unites these pools and finds the best price among them.

DODO also integrates other DeFi protocols to add liquidity including 0x and 1 inch.

DODO Pools

Liquidity pools make decentralized trading possible in the first place. DODO pools provide liquidity providers with the flexibility to create and manage their own chain-market making strategies in a totally non-permission and non-custodial manner.

The best thing is that liquidity providers do not need to provide paired tokens for DODO pools. They can deposit any number of base or quote tokens. According to the team, unlocking a single token repository gives LPs the flexibility to choose how they want to market.

If we look at the DODO application, there are three types of pools: public, linked, and private.

Public Pools

Public pools are also called the DODO Vending Machine (DVM) in the protocol. DVM allows anyone with a portfolio to create a liquidity market using DODO's PMM technology to create a binding curve for the provisioned tokens. Pool creators only need to provide the tokens and set the desired price curve, and the DODO vending machine will create a liquidity market for the asset.

As the name suggests, anyone can add liquidity to these portfolios and share the accumulated trading fees in proportion to their percentage of the portfolio. Pool parameters cannot be modified after creation.

DODO Private Pools

Also called DPP , these pools are for professional market makers with special features that the DODO Vending Machine (DVM) cannot satisfy. In DPP, creators can create pools that only require a token. Only the creator of the pool can provide liquidity to that pool. Unlike DVM, pool creators can change the price curve at any time.

Pegged DODO Pools

According to DODO, these pools are suitable for synthetic assets. They are like public pools where anyone can provide liquidity and pool parameters, token type, number of tokens, trade fee rate, start price and slip coefficient cannot be changed after creation.

crowdpool

DODO provides the ability to issue new assets at the lowest cost and create pools of highly liquid capital through Crowdpool. In DODO, anyone can create their own token without any coding. The token creator can then distribute their token through DODO Crowdpool.

DODO also attracts new cryptocurrency projects with a free listing as an initial DODO (IDO) offering on its Crowdpool resource. The documentation describes Crowdpool as:

“Crowdpool is an equal opportunity way to distribute tokens and initiate liquidity markets. Inspired by the call auction mechanism common in the securities markets, Crowdpool ensures there is no interference from bots or front-running. ”

Any project or individual that wants to distribute their tokens just to provide them and define a soft cap. DODO V2 currently supports two types of Crowdpool (CP): Fixed Price CP and Variable Price CP. Then they can set the start and end date.

IDO projects only need to deposit their own tokens in the liquidity pool. A portion of the tokens will be used for crowdfunding and the remainder will be used for sell-side liquidity in the pool. Once the Crowdpool campaign ends, participants can claim tokens based on their wagers at the pre-set initial bid price.

Thereafter, new public liquidity pools will automatically be created with the capital raised and the tokens reserved for sell and trade side liquidity will be available for the token.

Mining

DODO platform users can earn DODO token rewards by engaging in liquidity mining, commercial mining and Combiner Harvest mining, which are targeted at liquidity providers, traders and pool builders respectively.

Traders can extract DODO tokens when trading on the DODO exchange. Liquidity providers provide liquidity to DODO pools and receive DODO LP tokens. They can wager these LP tokens to earn liquidity mining rewards.

In addition to commercial mining and traditional liquidity mining, pool makers and liquidity providers can also get involved by participating in Combiner Harvest mining. The documentation describes this feature as:

“A program that aims to give platform users exposure to promising projects that want to collaborate with DODO. Under this system, approved projects can create liquidity pools in DODO and those that provide liquidity to these pools will earn DODO reward tokens. ”

DODO NFT Vault

According to its website, DODO NFT Vault is a price and liquidity discovery protocol for non-standard assets. This feature allows users to create new or use existing NFTs and place them in the DODO NFT Vault. These NFTs in the DODO NFT Vault are split into multiple parts with fungible ERC20 tokens issued to represent them.

Then, a liquidity pool powered by DODO's PMM algorithm is established to trade these tokens. These ERC20 tokens can be traded using DODO's SmartTrade and liquidity aggregation service at the best price.

This NFT slicing is similar to a public company that issues its shares. In this way, DODO gives rise to a highly active and efficient NFT secondary market. These fungible ERC20 tokens, created by breaking an NFT into pieces, can be traded through cryptocurrency exchanges and used in loan protocols, for trading derivatives, and in many other scenarios.

DODO token

The DODO token is the protocol's native ERC20 token used for governance and encouragement of liquidity provisioning. There is a total stock of 1 billion tokens, with 110.551.965 or 11% of the total stock outstanding.

With the release of DODO V2 in January 2021, the DODO token received two new utilities for holders: Crowdpool and IDO allocations and discounts on DODO trading fees. In V2, a DODO loyalty program was also introduced, in which users can mint a non-transferable vDODO token.

This vDODO token serves as proof of membership in the DODO loyalty program. vDODO tokens can be minted at a fixed rate of 1 vDODO = 100 DODO. The vDODO token offers some extra privileges to holders such as trading fee dividends, membership rewards and extra voting power, in addition to the same benefits of owning DODO tokens.

DODO holders can vote for governance, but 1 DODO is always equal to 1 vote. They can participate in crowdfunding and IDO allocation, and get discounted trading fees. While vDODO holders can cast 100 votes holding 1 vDODO. In addition to Crowdpool and merchant discounts, they also earn a share of the merchant fees accumulated on the platform and receive DODO membership rewards after each lock cycle.

How is the DODO Network Secured?

DODO is a decentralized protocol and is therefore resistant to centralized network attacks that rely on a single flaw. DODO smart contracts were audited by PeckShield, a security company blockchainon July 10, 2020.

Be aware that DeFi protocols are innovative high-risk projects and thus vulnerable to coding bugs and security issues that can be exploited by hackers and result in lost funds.

What is the Price Forecast for the DODO cryptocurrency?

The price of DODO is forecast to peak at $2.334 throughout 2022.

As early as 2023 according to our crypto price prediction index, DODO may reach a maximum level of $3.963, with the average trading price being $2.947.

In 2025 according to our crypto price prediction index, DODO should cross an average price level of $3.497, the minimum expected value of DODO price at the end of the current year should be $3.863. Additionally, DODO can reach a maximum price level of $4.137.

Where to buy DODO?

The DODO cryptocurrency can be traded on the following exchanges:

- Binance

- KuCoin

- Gate.io

- FTX

- MEXC

Conclusion

DODO is one of the most promising digital assets on the market, with a range of features to offer a savvy investor. The site boasts a range of incredible advantages over conventional and centralized encryption exchange platforms, ranging from greater security against hackers to allowing merchants better control over their finances, be they euros, dollars or otherwise.

Disclaimer of Liability : PortaCripto is a news portal and does not provide any financial advice. PortaCripto's role is to inform the community about cryptocurrencies and what is happening in this space. Do your own due diligence before making any investments. PortaCripto will not be responsible for any loss of funds.