BurgerSwap is a decentralized exchange built on top of the Binance Smart Chain (BSC) that allows users to conduct cryptocurrency exchanges facilitated by its automated market maker (AMM).

BurgerSwap features several incentive systems to encourage more users to provide liquidity to the protocol. And with an increase in their liquidity, users can expect more efficient trades than before, without incurring high gas fees.

In this article, we will discuss:

What is BurgerSwap (BURGER)?

BurgerSwap is a decentralized exchange built on top of the BSC. It allows users to perform cryptocurrency exchanges, which are facilitated by its AMM. AMM is backed by its liquidity pool where users can provide tokens in exchange for platform rewards.

The main purpose of the platform is to solve the problem of most Ethereum based exchanges with gas fees, price slippage and slow transaction speeds. Through its ETH-BSC bridge, users can also easily exchange their ERC-20 tokens on BurgerSwap.

Ultimately, the architecture of the platform is very similar to projects in the same space like PancakeSwap, BakerySwap, and many others. BurgerSwap's AMM model offers incentives to its users if they provide liquidity to the exchange.

How Does BurgerSwap (BURGER) Work?

BurgerSwap is among the first DeFi platforms deployed at BSC. It is a project that aims to make the products and services available on DeFi much cheaper and more reliable. Since the platform was released, there have been no reports of any issues from users so far, which is a testament to its reliability.

Learning from the poor experiences of other platforms and their users, BurgerSwap's smart contracts were audited by a blockchain respectable name Beosin. This decreases the likelihood of errors or buggy smart contracts, which have been the bane of most DeFi protocols to date. It should still be noted, however, that depositing assets into smart contracts is not without risk. Caution is still necessary whenever you decide to transact using DeFi platforms.

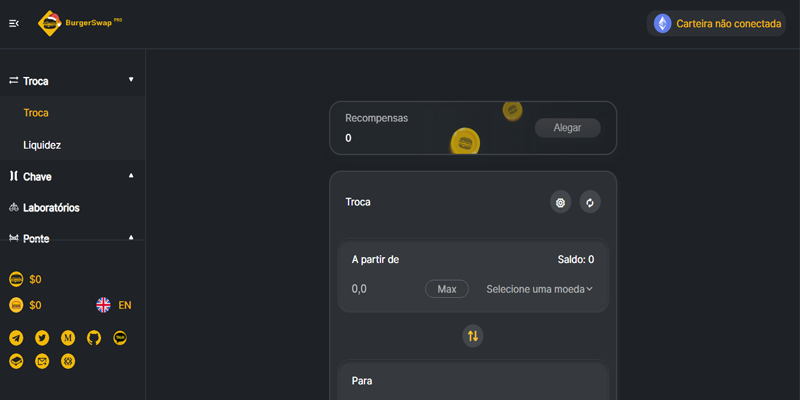

Configuring BurgerSwap

It's pretty easy to configure BurgerSwap. All you need is an online wallet such as MetaMask, TrustWallet, MathWallet, TokenPocket and Binance Chain Wallet. When you already have one, simply go to the website and link your wallet to start trading.

You will need BURGER tokens on the platform to facilitate your transactions. To acquire them, you can buy them immediately on cryptocurrency exchanges that list the token or by buying Binance Coin (BNB). If you already have BNB, you can transfer them to the linked wallet on the platform and exchange them with BURGER.

When trading on the platform, you will have the option to adjust the slippage tolerance for your swap. This refers to the level of price change you are willing to tolerate when conducting your trade. You can freely set it around 0,1%, 0,5% or 1%. If you are exchanging other tokens as well, you can follow these same considerations as well.

Liquidity mining

As already mentioned, BurgerSwap AMM is powered by a liquidity pool. This is a pool of cryptocurrency tokens of exchange users and is used to facilitate trading and exchange of tokens on the platform. Users who provide assets in the portfolio are called liquidity providers (LP).

LPs receive rewards proportional to the amount of assets they lock into liquidity pools in the form of BURGER tokens. To provide liquidity to the platform, a user needs BNB, as the blockchain requires gas rates.

Also, make sure the tokens you want to provide the pool are in the BEP-20 blockchain, which is the default for Binance Smart Chain. You can exchange your ERC-20-based assets into BEP-20 supported tokens using the platform's cross-chain bridge.

There are already many liquidity pools to choose from, but if you want to open a new liquidity pool, you can start a new one for a pair of tokens of your choice. Remember, however, that you must deposit both trading pairs in the portfolio. There is also a minimum percentage of token deposits that you need to consider to provide liquidity to a pair of tokens and $BNB.

Keep in mind, however, that only BNB and BURGER pairs can be used to extract BURGER tokens. Providing liquidity to other token pairs does not generate BURGER rewards.

What makes Burger Swap unique?

An automated market maker is a type of decentralized exchange ( DEX ) that uses mathematical formulas and game theory to price assets. Burger Swap is a decentralized AMM in the BSC network.

The Burger Swap Bridge has the ability to exchange currencies from the Ethereum Network's ERC-20 (ETH) standard to the BSC's BEP-20 standard – and vice versa – at low rates. It allows Ethereum users to seamlessly migrate to the BSC network and take advantage of its low transaction rates and fast blocking times.

Burger Swap was conceived as a democratic and decentralized exchange with mandatory governance. BURGER token holders can vote to change trading parameters such as trading rates, mining speed, wagering rewards and more.

All tokens available in Burger Swap have a BNB trading pair and a BURGER. The BURGER pair is used to generate liquidity for the BURGER token and the BNB is the native token of the BSC network.

When a new project wants to be listed on Burger Swap, the exchange charges a listing fee and allows the community to approve or reject the listing through a vote. All listing fees are added to a pool and shared among BURGER holders who participate in the vote at least once a week.

Community

BurgerSwap is a proudly democratized and decentralized (DEX) exchange. The platform is built for the community and continues to grow to meet the needs and desires of the community as a whole, not just those that generate the most revenue for the platform. Consequently, community governance is mandatory.

The BurgerSwap team believes that current governance models in DeFi fail to govern many protocols. Token pairs are added and metrics are adjusted, but for most DeFi apps, a change to the smart contract code is required for the actual change to take place. BurgerSwap token holders can vote to change parameters like trading rates, mining speed, wagering rewards and more! Additionally, only those who participate in the vote are eligible to receive token staking BURGER rewards.

Listing and Exclusion

Before a newly proposed project can be listed, it must first reach maturity. Thereafter, a project must be scrutinized by the BurgerSwap community through a governance vote. In addition, a voting mechanism will be implemented to remove tokens associated with fraudulent projects. If a project is removed from the list, the listing fees paid for the fraudulent project will be distributed among BURGER token holders who vote once a week.

Burger Token

BURGER is the platform's native utility token. It can be used for transaction fees, trading, betting and voting functions. There are many ways to earn BURGER tokens. In addition to providing liquidity to AMM pools, users can also choose to wager some supported tokens through Burger Shack.

Grabbing the Burger Shack

There are assets, in addition to BURGER, that can be bet on the protocol's smart contracts, such as BNB, BUSD, USDT, BTCB, MDX, HMDX and ETH. In return, users earn USDT and xBURGER.

All assets deposited in Burger Shack's smart contract are distributed to income pools that offer the best returns in order to ensure the greatest rewards for the stakers. The reward for their bet is also proportional to the amount of tokens they deposit. This is a preferable choice for those who don't want to risk an impermanent loss.

Deploy via xBurger Pool

There is also the option to deposit assets into the xBurger pool. This provides the BURGER and xBURGER stakers simultaneously. Here are the trading pairs that can be bet on the xBurger pool: xBURGER / BURGER, xBURGER / USDT, xBURGER / BNB.

liquidity agriculture

Liquidity providers receive BLP tokens when depositing assets into liquidity pools. BLP tokens, in turn, can also be wagered on Burger Farms. They can be removed at any time the user decides.

Loan

BurgerSwap allows users to lend their assets to other interested buyers. What the protocol does is aggregate all assets designated for loan, which other platform users can leverage for a specified amount of interest. Then, all interest charged on loans made through the pool is distributed to taxpayers in proportion to the amount of their deposit.

Leadership

BURGER Token Stakers make up the community that governs the direction of the protocol. This means they have the ability to make and approve proposals related to platform parameters such as transaction fees and blocking rewards, among others. If the proposal that a staker voted on is approved, they will also receive incentives in return.

Where can you buy BurgerSwap (BURGER)?

Burger Swap (BURGER) can be traded on the following exchanges:

- Binance

- MXC.COM

- PancakeSwap

- Burger Swap

Conclusion

With the emergence of many decentralized exchanges (DEXs) in space, it's worth examining their incentive structure to determine how they intend to get people to support their platform. It is not enough for them to create liquidity pools or AMMs. There should also be several options for users to contribute their idle assets to the market for a certain amount of rewards.

BurgerSwap has a promising approach in this particular aspect. Using the platform's native token or any other compatible cryptocurrency asset, they can earn more tokens as a reward. Using advanced DeFi concepts such as liquidity mining and agricultural production, users can also produce optimal returns from their investments. With this reward structure, adoption is not a distant achievable goal for the project. And, in turn, this complements the project's objective of achieving better liquidity.

Disclaimer of Liability : PortaCripto is a news portal and does not provide any financial advice. PortaCripto's role is to inform the community about cryptocurrencies and what is happening in this space. Do your own due diligence before making any investments. PortaCripto will not be responsible for any loss of funds.