On May 21, the crypto market was hit with a new round of fear, uncertainty and doubt (FUD), which spawned another, albeit more discreet, price sell-off for Bitcoin (BTC) and most altcoins.

For the second time in less than 3 weeks, China was once again blamed for rumors that regulators were trying to crack down on Bitcoin mining and trading. The media also reported that Hong Kong authorities have proposed banning retail traders from trading in cryptocurrencies.

Data TradingView show that Bitcoin (BTC) bulls were holding the $40.000 support level before the China announcement, but quickly lost it and had to regroup at the $36.000 support before another drop occurred.

BTC chart / USDT of 4 hours.

While the turnaround seen on the market on Thursday helped to ease fears of a return to a cryptographic winter, some analysts, including Jarvis Labs co-founder Ben Lilly, correctly assessed that "we are not out of danger" before the Friday reduction.

Still, there is room for hope that the BTC price manage to hold steady and move higher as activity seen in whale portfolios showed heavy inflows at $39.931, indicating a new possible support level.

Significant inflows to whale wallet happened at $ 39,931 (around 115k BTC). This should now be a support for # Bitcoin🇧🇷 Closest resistances are at 52 and 56k. pic.twitter.com/XnsNQ35BFZ

- whalemap (@whale_map) May 21, 2021

In this article, we will discuss:

Foreign exchange activity increases during settlement

Cryptocurrency exchanges played a big role in Wednesday's price action, as highlighted in Ashwath Balakrishnan's recent Delphi Daily report.

According to Balakrishnan, Binance was responsible for:

“Facilitating nearly $100 billion in spot trades” and decentralized exchanges on the Ethereum (ETH) network “recording over $10 billion in volume”

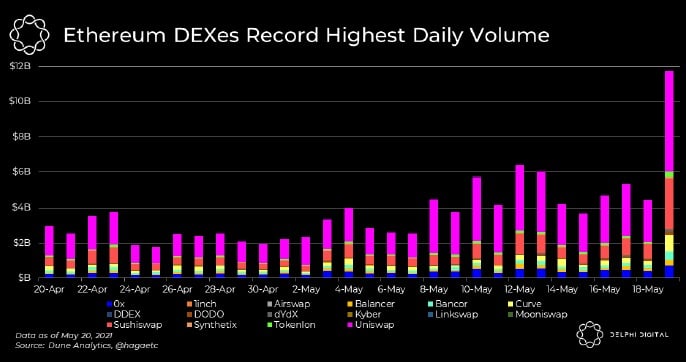

Daily volume of Ethereum DEX.

This marked the “single largest volume day for all DEXes” ever recorded, led by Uniswap (UNI), which saw “almost $ 6 billion in volume” traded as retail traders rushed for exits.

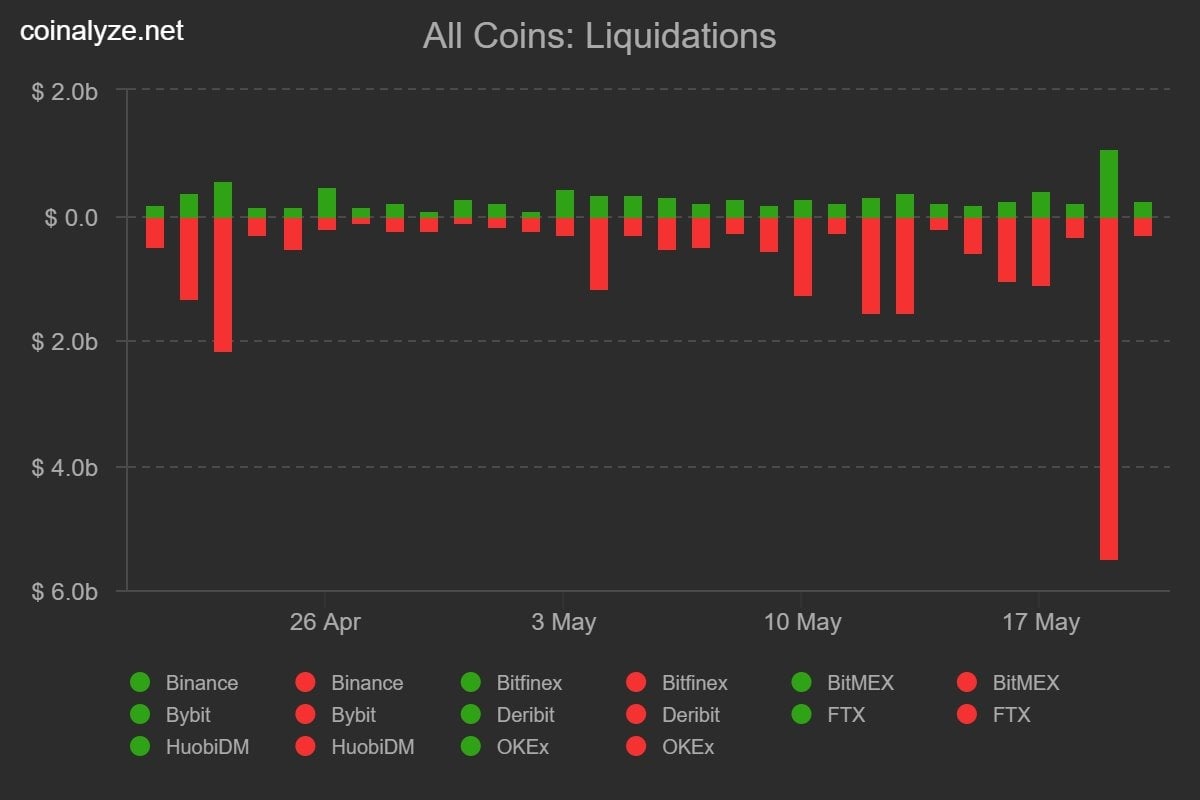

According to Micah Spruill, managing partner and investment director at S2F Capital, approximately $ 9 billion in value was settled during this week's correction in a wash similar to what was experienced in March 2020.

All settlements of currencies in centralized exchanges.

Spruill also pointed to “historic Bitcoin levels being withdrawn from the stock exchange on May 19, compared to net foreign exchange outflows in recent years”, highlighting the fact that this was the largest amount of dollar-denominated net outflows in history and is "Extremely optimistic."

To gain a better understanding of the current sentiment of traders in the market, Spruill pointed out that retail portfolios continued to grow in numbers, despite the market turmoil, with the decline being quickly bought by retail investors, which is “a sign of continuous growth and adoption. "

Spruill said:

The number of new entities has also increased this contraction, pointing even more to the fact that we have not experienced a top of the bullish cycle, but rather a local top within a large bullish cycle.

Smashed altcoins, again

The continued pressure on Bitcoin spilled over into the altcoin market, causing most tokens in the top 100 to fall further into the red.

daily performance of cryptocurrency market.

The overall capitalization of the cryptocurrency market is now $ 1,4 trillion and Bitcoin's dominance rate is 44,3%.