In this article, we will discuss:

What is Return on Investment (ROI)?

Return on Investment, known by the acronym ROI, is um financial criterion used to determine the effectiveness or profitability of an investment, as well as to make comparisons between the effectiveness of multiple different investments. The purpose of ROI is to directly evaluate the amount of return obtained from a specific investment compared to its cost.

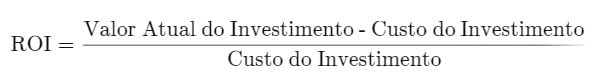

The ROI calculation is carried out by dividing the profit (or return) obtained from the investment by its initial cost. The result is presented as a percentage or ratio.

How to Calculate Return on Investment (ROI)

The return on investment (ROI) formula is as follows:

The term “Current Value of the Investment” designates the amount received from the sale of the investment in question. Since ROI is expressed in percentage terms, it makes it easier to compare with other investments, allowing a comprehensive assessment of different forms of investment in relation to one another.

Why is ROI Considered a Useful Measurement?

Due to its simplicity and adaptability, ROI is widely adopted as a financial metric. It primarily serves as a basic indication of the profitability of an investment. This may include, for example, the ROI of a stock investment, the return expected by a company when expanding its facilities, or the income from a real estate operation.

The calculation formula is simple and its results are easily understood, given its applicability to a wide range of situations. A positive ROI generally indicates a profitable investment. However, if there are alternatives with higher ROIs, this can guide investors in selecting the best opportunities, while investments with negative ROI, which signal a net loss, should be avoided.

For example, if Jo invested R$1.000 in the company Slice Pizza Corp. in 2017 and sold his stake for R$1.200 a year later, the net profit of R$200 divided by the investment cost of R$1.000 would result in an ROI of 20%. This analysis allows you to compare the investment in Slice Pizza with other opportunities. Assuming that Jo also invested R$2.000 in Big-Sale Stores Inc. in 2014, selling her shares for R$2.800 in 2017, the ROI would be 40%.

What are the Limitations of ROI?

This method, illustrated by Jo's example, highlights some limitations in applying ROI, especially when comparing investments. Although Jo's second investment had a double ROI compared to the first, the investment period was one year for the first and three years for the second.

An adjustment to the annualized ROI can be made for the longer duration investment. Considering a total ROI of 40%, dividing by 3 would result in an annualized return of 13,33%. This adjustment suggests that, although the second investment provided greater total profit, the first investment was more efficient in annual terms.

In addition to ROI, other metrics such as Rate of Return (RoR), which considers the duration of the investment, and Net Present Value (NPV), which adjusts for variations in the value of money over time due to inflation, can be used together. The integration of NPV into the RoR calculation is often referred to as the real rate of return.

Expanded Applications of Return on Investment (ROI)

In recent years, interest from investors and organizations has expanded to encompass new Return on Investment methodologies such as Social Return on Investment (SROI). Created in the late 90s, SROI assesses the most comprehensive impacts of projects, considering extra-financial values, that is, social and environmental indicators that are not traditionally reflected in financial statements.

SROI is instrumental in quantifying the value of environmental, social and governance (ESG) initiatives that are fundamental to Socially Responsible Investing (SRI) practices.

An example of this is a company that chooses to implement water recycling systems in its facilities and exchange its conventional lighting for LED lamps. Although such measures entail immediate costs that can negatively affect traditional ROI, the net benefits to society and the environment can result in a positive SROI.

Several other variants of ROI have been developed for specific purposes. For example, social media ROI measures the effectiveness of social media campaigns, such as the number of clicks or likes generated by a given effort. Similarly, ROI in marketing seeks to quantify the returns attributable to advertising actions or marketing campaigns.

Conclusion

Return on Investment (ROI) emerges as a fundamental tool for evaluating the financial efficiency of investments, offering critical insights for both individual investors and organizations. Its applicability extends from traditional profitability analysis to more innovative approaches such as Social Return on Investment (SROI), reflecting a growing awareness of the importance of considering environmental and social impacts in investment decisions.

The ROI calculation, due to its simplicity and versatility, allows a direct comparison between different investments, helping to identify opportunities that best align with investors' financial objectives and ethical values. However, the limitations of ROI, including the lack of consideration for the time value of money and the difficulty in comparing investments with different time horizons, highlight the need to combine this metric with other financial assessments such as Net Present Value ( NPV) and the Internal Rate of Return (IRR), for a more comprehensive analysis.

As the economic landscape evolves, with an increasing focus on sustainability and social responsibility, the development of new variants of ROI attests to the adaptation of investment practices to contemporary demands. Investors and companies that recognize and integrate these values into their strategies not only contribute to positive social and environmental impact, but can also discover new avenues for long-term value creation.

Therefore, ROI remains an essential metric in the investment evaluation arsenal, providing a solid basis for making financial decisions. Awareness of its limitations and the complementary use of other financial metrics enrich the analysis process, leading to more informed investment choices aligned with sustainability and profitability objectives in today's world.

FAQ

What is ROI in a Simplified Form?

Return on Investment (ROI) is a metric that indicates the profit or loss generated by an investment or project, after considering its cost.

How is Return on Investment (ROI) calculated?

To calculate ROI, the profit obtained from an investment is divided by the cost of that investment. For example, an investment that generates a profit of $100 with a cost of $100 would have an ROI of 1, or 100%, when expressed as a percentage. Despite being a quick and simple measure to estimate the success of an investment, ROI has important limitations, such as not considering the time value of money, and the difficulty of comparing the ROIs of investments with different periods to generate profits. For these reasons, professional investors often prefer other metrics, such as Net Present Value (NPV) or Internal Rate of Return (IRR).

What Constitutes a Good ROI?

What is considered a “good” ROI varies depending on the investor's risk tolerance and the period needed for the investment to generate a return. Generally speaking, more risk-averse investors may settle for lower ROIs in exchange for less risk exposure. Investments that require more time to deliver returns tend to require higher ROIs to attract investors.

Which Sectors Have the Highest ROIs?

Historically, the average annual return for the S&P 500 has been around 10%. However, this index can vary significantly between different sectors. In 2020, for example, many technology companies achieved annual returns significantly higher than this average, while sectors such as energy and utilities had lower ROIs, and in some cases, recorded losses. An industry's average ROI can change over time due to factors such as increased competition, technological advances and changing consumer preferences.