Decentralized exchanges (DEXs) allow users to trade directly with each other, without going through a centralized intermediary such as Coinbase and Binance. This means they can offer access to a wider range of cryptocurrency tokens and financial services than you'll find on popular centralized exchanges, as well as allowing trading without an intermediary or the need to provide identifying information.

SushiSwap has emerged as a popular rival to the leading DEX, Uniswap, which makes sense: it's actually based on Uniswap code!

Although SushiSwap has a controversial and drama-filled release, it has stabilized and now features sophisticated design, plus a growing range of decentralized ( DeFi ) financial products and services such as agricultural production, SUSHI token deposit, loans and new offers of tokens. See how to become a “DeFi chef” with SushiSwap, as well as take a look at its volatile history and SUSHI token.

In this article, we will discuss:

What is SushiSwap?

SushiSwap is an Ethereum-based decentralized exchange that allows you to exchange a vast array of tokens, as well as engage in other financial services. It has no centralized authority or intermediaries. Instead, it relies on smart contracts – or code that automates processes – and liquidity provided by other users to complete trades. SushiSwap is similar to unitedwap, which also runs on Ethereum, much like the current Binance Smart based PancakeSwap.

The history of SushiSwap

SushiSwap was launched in August 2020 and quickly generated controversy. Pseudonym creator Chef Nomi and his collaborators copied (or forked) Uniswap's open source code, but made a fundamental change: adding a governance token, SUSHI, that users could buy and earn to have a say in the future the DEX.

Along with this remarkable change, SushiSwap wanted to crush Uniswap and assume its throne as the most popular Ethereum DEX. The creators devised a “vampiric mining” scheme to drain Uniswap liquidity through incentives: providing SUSHI in exchange for users' Uniswap liquidity pool (LP) tokens. These LP tokens would then be exchanged for the original assets placed in Uniswap's liquidity pools, thus creating liquidity for SushiSwap.

And there are probably hundreds of other people that I did not mention here, but well deserve an apology from me.

- Chef Nomi #SushiSwap (@NomiChef) September 11, 2020

If that wasn't bold and controversial enough, a new twist came before the vampire mining campaign could be completed: Chef Nomi has withdrawn nearly $14 million in SUSHI from DEX developer funds for Ethereum – on Uniswap, no less . The price of SUSHI plummeted and Nomi was assaulted by users who thought they had just cheated or “pulled the rug” by the newly formed SushiSwap community.

Nomi reversed course and returned the funds and finally decided to withdraw from SushiSwap. Control over the project was handed over to Sam Bankman-Fried, head of Alameda Research and centralized derivatives trading platform FTX, who oversaw the successful completion of the vampire mining campaign. He then handed over control to several trusted community members, securing SushiSwap's decentralized future. To users' relief, SushiSwap has gone through a much less tumultuous race since then.

How does SushiSwap work?

Like Uniswap, SushiSwap is built on an automated market maker (AMM) system that uses the smart contracts mentioned above to complete transactions. Tokens are provided by other users through liquidity pools. Other SushiSwap users lock their funds into token pairs for these pools, which provide the funds needed to complete the exchanges. These users are rewarded with a small percentage of the fees generated by the trades, a process called yield farming.

In addition to token exchanges, SushiSwap offers other DeFi features such as the ability to wager SUSHI coins on the network and earn rewards, as well as participate in loan services and acquire DeFi startups from newly offered tokens through its MISO service .

What's so special about that?

Even though it started with the Uniswap codebase, SushiSwap has made significant changes to differentiate itself from its inspiration (and rival). The SUSHI token was a DeFi innovation that eventually led Uniswap to take a similar approach, providing users not only with an additional means of generating rewards, but also a say in the future of DEX.

Furthermore, while Uniswap has raised venture capital funds and has a central and centralized development team, SushiSwap's decentralized and community-centric ethos extends beyond DEX itself.

How to make your first deal on SushiSwap

As with other DEXs, you will need an encryption wallet like MetaMask , WalletConnect or Lattice to use SushiSwap. It also works with the Coinbase Wallet, which does not require an account with centralized Coinbase trading. Unlike centralized exchanges, SushiSwap does not force you to register an account or provide identifying information – you only need a wallet. However, you cannot use a debit card or bank account to purchase fiat currency encryption on SushiSwap.

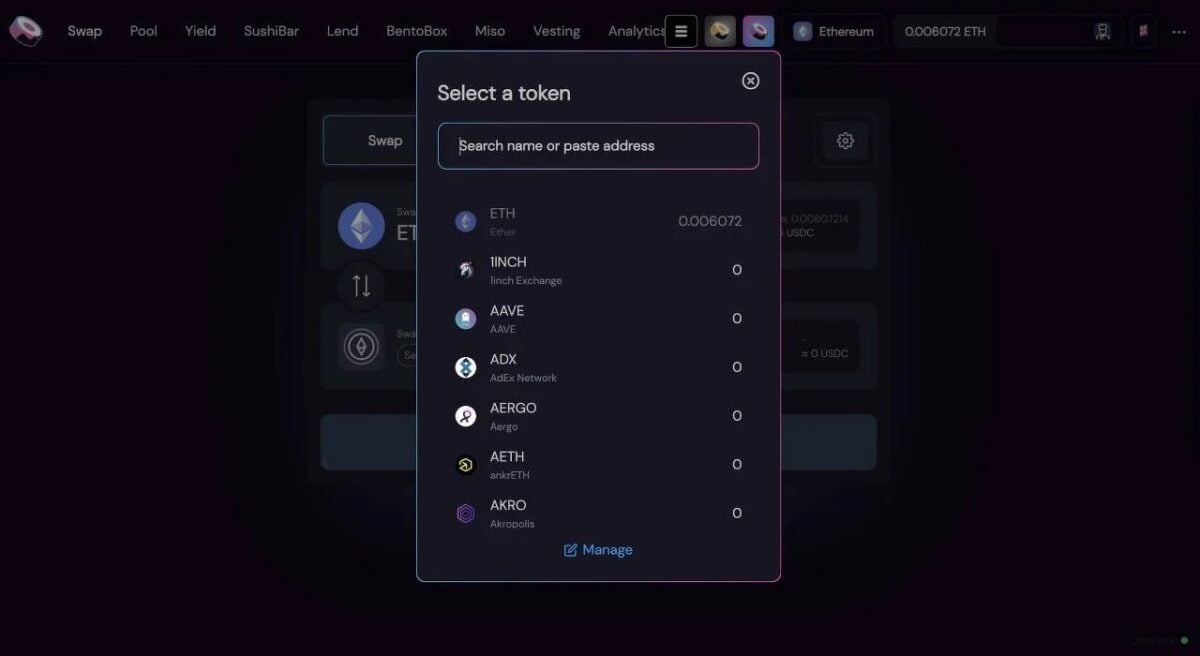

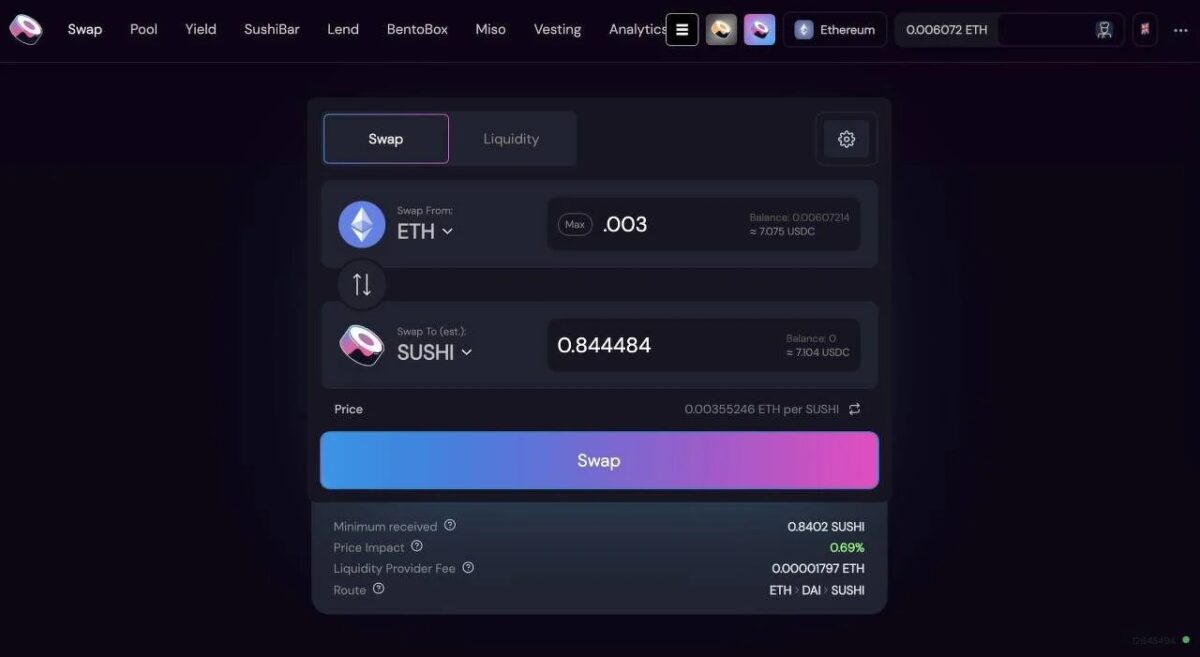

After logging in with a wallet, go to the “Trade” feature in SushiSwap and choose which cryptocurrency in your wallet (such as Ethereum) you want to trade and which token you want to trade. SushiSwap allows anyone to create a trading pair and establish a liquidity pool, so it supports a wide variety of Ethereum based tokens as well as other currencies packaged for use in Ethereum.

After choosing which tokens to exchange, enter the amount of your token you want to exchange and SushiSwap will tell you how much of the other token you will receive in exchange. If you are satisfied with the exchange rate, click the Swap with rainbow button to execute the transaction. It may take a few minutes to complete the trade, but if it is successful, the new tokens will appear in your wallet.

Where and how to buy SUSHI

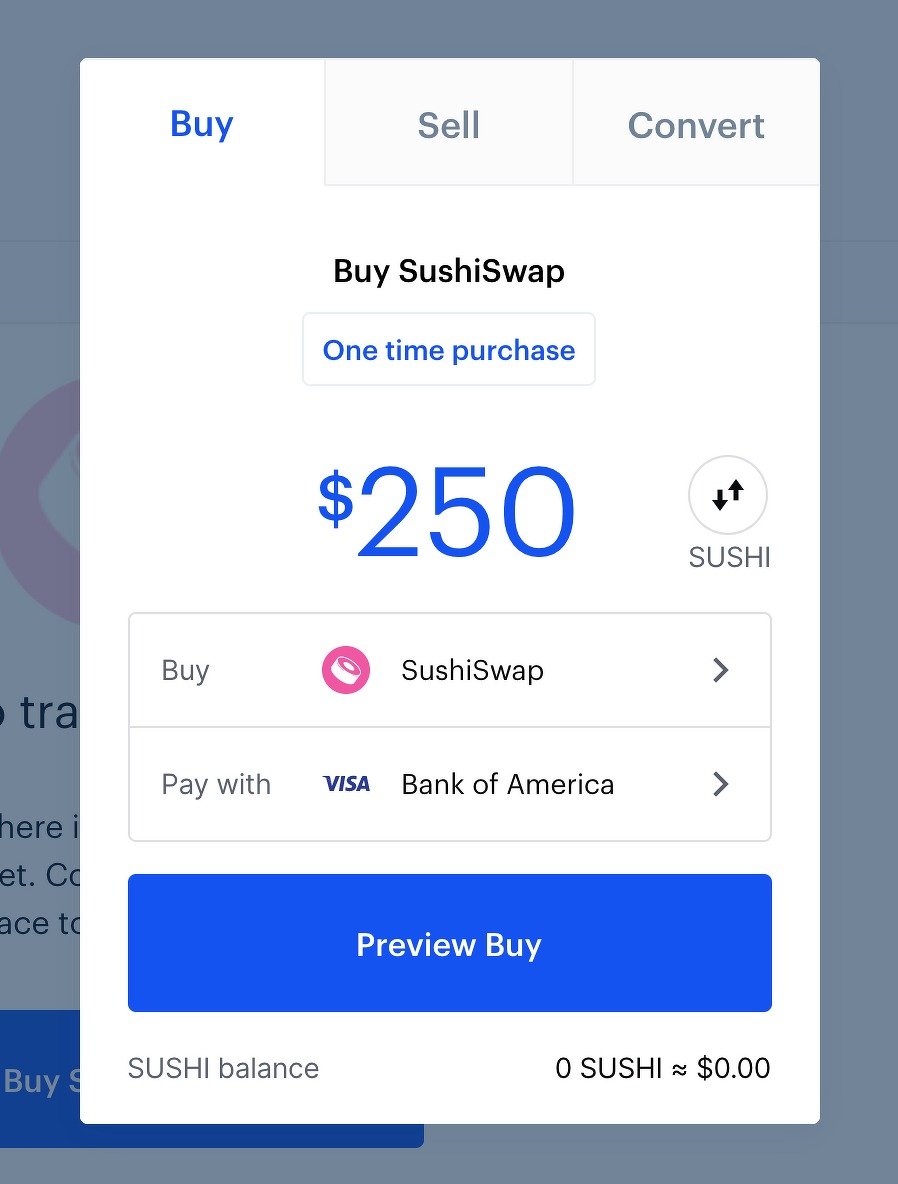

You can switch to SUSHI on SushiSwap, of course, or even on Uniswap. If you'd rather buy SUSHI tokens elsewhere, however, and then put them in SushiSwap, you can do that too. SUSHI tokens are available for purchase on a wide variety of exchanges, including Coinbase, Binance, FTX and Huobi Global.

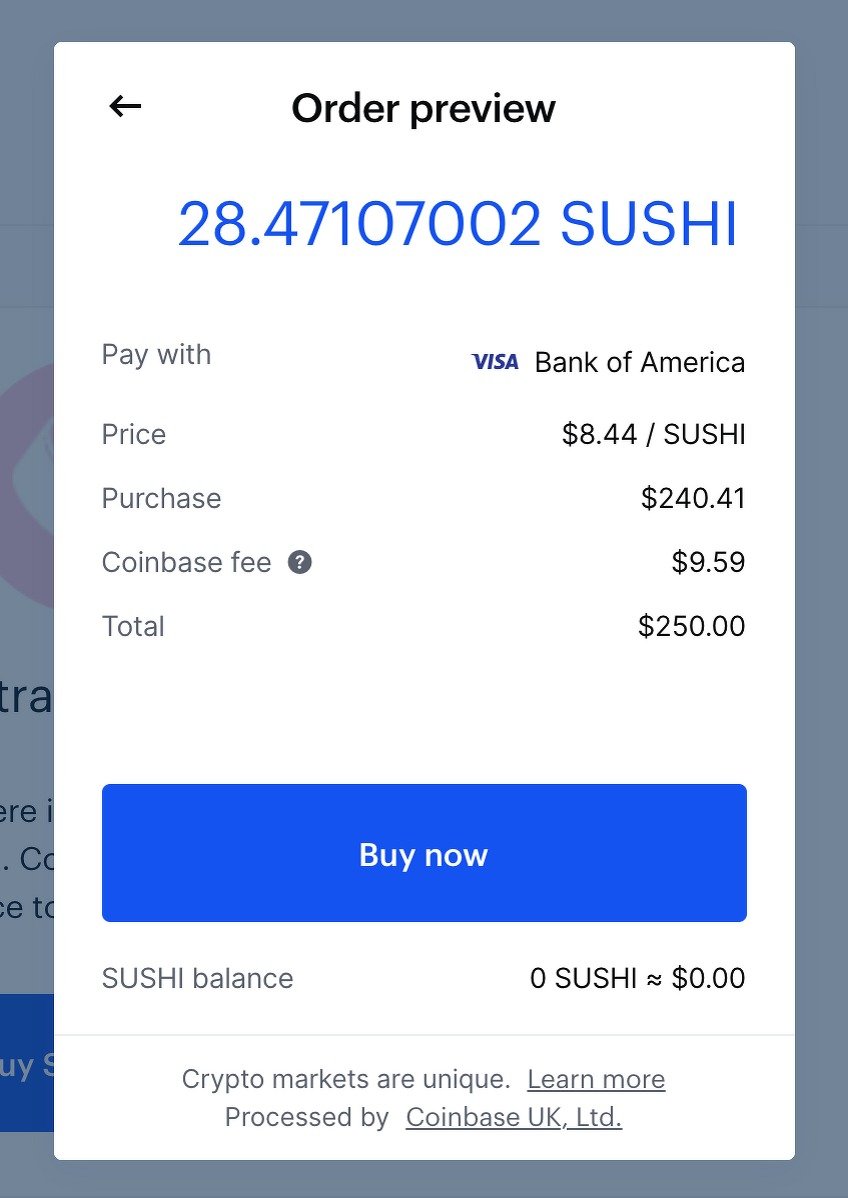

See how you can buy SUSHI at Coinbase. In this example, we intend to purchase $250 SUSHI using a linked bank account and, after charging the transaction fee, Coinbase offered to return 28,47 SUSHI in exchange. If the terms agree on your own transaction, click “Buy Now” and SUSHI will soon appear in your Coinbase account.

How does stakeout work? What is xSUSHI?

SushiSwap allows you to wager (or lock) your SUSHI tokens on the network to earn gradual rewards over time. According to DEX, 0,05% of the total swap fees are redistributed to users in proportion to the amount of SUSHI they wagered. When you wager your SUSHI, you will receive xSUSHI to hold. xSUSHI gives you voting rights and increases your rewards over time. When withdrawing your funds, you will get back the original SUSHI amount plus the extra amount you earned in rewards, minus fees.

The future

Just as SushiSwap came out of nowhere to challenge the dominant Uniswap, the DEX market is not static. Uniswap, for example, continues iterating its concept and released its DEX v3 in May 2021. Additionally, DEXs are starting to gain traction in other blockchains besides Ethereum, notably PancakeSwap and BurgerSwap in the Binance Smart Chain.

SushiSwap has already expanded considerably since its controversial launch and transfer of power, launching new features like BentoBox, a platform on which additional DeFi services can be built. The app has also undergone a significant overhaul of the look and feel, which is much more polished and easier to understand, and moved to the simpler sushi.com URL.

The Sushi Anons are really like $ SUSHI on Polygon, huh?

In less than one month you did it…

Welcome to the $1 Billion TVL Club!! https://t.co/4dqdGycqCg pic.twitter.com/d1RmwYEf4v— SushiChef (@SushiSwap) June 3, 2021

Like other Ethereum-based apps and platforms, SushiSwap has seen an increase in gas and transaction fees due to high network congestion. With this in mind, SushiSwap is now expanding to other block chains and adopting tier 2 scaling solutions to minimize fees and speed up transaction confirmations.

SushiSwap has released a version of its DEX blockchain on Polygon (formerlyMatic) and created a bridge that allows users to move Ethereum assets back and forth between the two DEXs.