Launched in October 2010, Clover Finance is a blockchain infrastructure platform aimed at cross-chain compatibility for decentralized finance (DeFi) applications. At the time of this writing, Clover Finance (CLV) was trading at $1,48 per token, with a limited circulating supply of 128 million coins, for a total market capitalization of $189 million.

In this article, we will discuss:

What is Clover Finance?

Clover is a centralized DeFi service provider running on the Polkadot (DOT) Substrate framework. Substrate is the base layer of Polkadot and is a blockchain autonomous technology that allows developers to build extremely sophisticated and personalized blockchains. Clover also aspires to compete as a parachute on the Polkadot network. If Clover receives a parachain slot, it can process transactions in parallel and achieve the scalability of the Polkadot network.

Clover has been described as a foundational layer for cross-chain compatibility intended to address the current lack of blockchain communications. It is the first non-custodial and fully decentralized cross-chain bridge from Ethereum (ETH) to Polkadot.

Clover's interoperable blockchain infrastructure aims to power cross-chain permissionless interactions between the Ethereum and Polkadot networks, providing broad support for Ethereum Virtual Machine (EVM)-based applications. For that purpose, it also has a built-in bidirectional peg (2WP) design for token transfers to and from the two networks, and a diverse selection of substrate-native developer tools.

Clover has developed its own 2WP technology in-house, utilizing the built-in SPV Simulation Technology, which enables smooth cross-chain communication between blockchains. This bidirectional peg system is a critical component of Clover's architecture as it seeks to solve some of the problems of centralized components that remain in the cross-chain DeFi space.

As an added bonus, Clover wants to become the ideal ETH-DOT bridge protocol. For this purpose, it makes use of its built-in cross-chain interoperability and adds new value propositions to DeFi in Polkadot. These features are made possible by the architectural hybridity of the Clover protocol.

In addition to its cross-chain capabilities, Clover is creating a fundamental layer for decentralized applications ( DApp ) to operate flawlessly. This is achieved by lowering the development threshold for DApps through the execution of substrate structures. With Polkadot's Substrate framework, developers can write blockchain logic in many popular programming languages without having to stick to a primary language like Ethereum.

Second, supporting a gas-free transaction model to optimize the user experience. Thus, users do not need to pay high fees during network congestion, thus solving some of the difficulties that come with scalability. DApps on Clover will also benefit from a number of substrate-based developer tools, including identity-based scripting abilities and multiple digital signatures (multi-sig). These tools will help improve overall application protocol security. Implementing multi-sig functionality or Threshold Schnorr Signatures in particular also improves decentralization. With Schnorr Signatures, Clover can accommodate up to an unlimited number of signatories for transaction verification without requiring high gas fees.

In addition, the project is laying the groundwork for a DeFi-centric, cross-chain compliant integrated financial services-oriented platform in Polkadot. This will be achieved using the substrate base. The company's primary goal is to provide financial services to its platform users and other initiatives, such as modular DeFi protocols and application tools, to further its initial goals.

What does Clover Finance do?

Clover seeks to leverage Polkadot's market-leading cross-chain technology to provide its customers with the most seamless and hassle-free DeFi experience possible and to contribute to the DOT ecosystem. Clover's modular decentralized financial protocols include deposit liquidity, decentralized trading, decentralized lending, symbolic dividend, governance, and synthetic asset protocols. The details of these protocols are as follows:

Staking liquidity: Users can lock their tokens into decentralized staking pools to get yields and a net staking derivative like a tradable receipt. For example, a user bets DOT and receives SDOT in return.

Decentralized negotiation: similar to Uniswap (UNI), Clover Finance offers a decentralized exchange (DEX) based on the Automated Market Maker (AMM). In an AMM-based DEX, users can trade cryptographic assets automatically through liquidity pools instead of the order book used by centralized exchanges (CEX).

Decentralized loans: Clover Finance allows users to deposit funds into loan pools and become creditors. Users who wish to borrow funds can become borrowers by placing cryptographic assets as collateral. Lenders receive interest by providing assets and providing liquidity, while borrowers must pay interest to use the funds.

Token Dividend: users who participate in the network guaranteeing liquidity, trading and borrowing will receive token incentives. Each user's token dividend is based on two parameters, which are the number of tokens promised and the duration of the promise.

Governance: CLV token holders have the right to participate in decision-making for DeFi protocols. They can propose, vote on and implement changes such as new asset listings, new interest rate models and token reserve withdrawals.

Synthetic assets: users looking to redeem the staked derivatives for the underlying token need to wait a certain amount of time. For immediate redemptions, users can pay with part of their locked assets or CLV tokens.

Who is behind Clover Finance?

The Clover Finance cryptocurrency offering is one of the newest tokens for transitioning to a major exchange. This was developed by the same team that developed the Clover point of sale (POS) system. Small businesses can take orders, collect payments and manage inventory using this rapidly growing POS system. Initially, the company's foray into cryptocurrency was a little tricky. However, over time, the strategy starts to make a lot more sense.

Clover Finance raised $3 million in an initial investment this year, according to the company. A Polkadot-based parachain offering was made in order to raise funds for building a bridge between ETH and the Polkadot blockchains. He was successful in achieving that goal. Furthermore, there was a plan to establish a connection with the Bitcoin blockchain in the not too distant future. To put this in another light, Clover Finance's strategy is starting to come together. For nothing other than the fact that it is attracting investor attention. He is moving forward into a world where cryptocurrencies can be more readily used to pay for goods and services on a range of blockchains. Also, gas rates have been reduced.

Regarding the last point, Clover Finance is redefining how fee structures are set up. And, in the process, it's making the user experience more straightforward. Your intelligent “relayer” is programmed to act on behalf of the sender.

Essentially, this means that relays can pay for gas charges using the same token that consumers use to transact. This eliminates the need to rely on a basic cryptocurrency such as Ethereum. Transaction fees will be taken from the asset the user is dealing with in an automated way. It may seem apparent, but in the realm of cryptocurrencies it isn't. So it is a significant event.

For now, CLV seems to have a lot going for it. Obviously, interoperability between multiple blockchains is the most important thing to look out for first. But it can also make it easier than ever to use cryptocurrency as a legitimate form of payment. This shouldn't come as a surprise considering the fact that this is a company that relies on payment services.

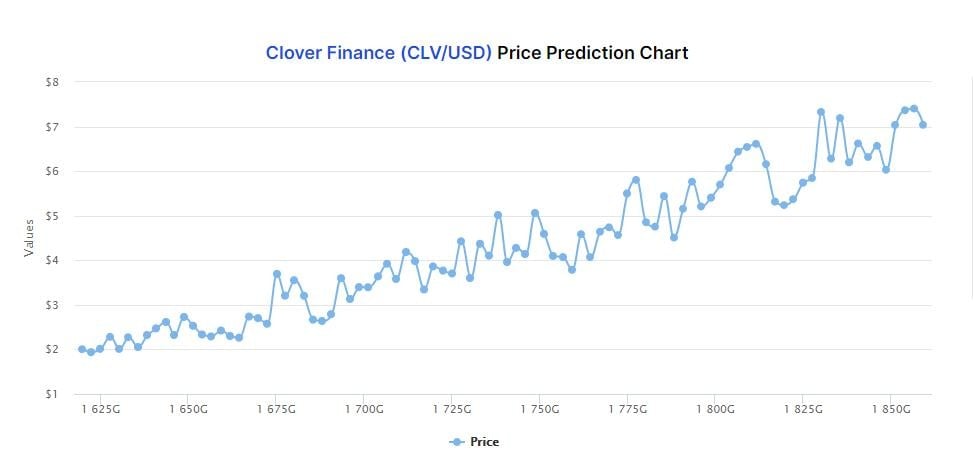

Clover Finance price history

The current price of CLV is $1,48. CLV's market capitalization is now valued at around $190 million, maintaining its position as the 258th position in the world rankings. However, CLV has a total supply of 1 billion tokens with only less than 129 million tokens in circulation. Therefore, when all tokens are outstanding, CLV will have a fully diluted market capitalization of $1,4 billion.

Investors who bought a discounted CLV currency on July 16 saw their money rise more than 170% to the current price of $1,40 per currency. Meanwhile, investors who bought the stock at its May high have fallen more than 90%.

Clover Finance's precipitous decline from its peak can be attributed to the current sell-off in the cryptographic market. The price of cryptocurrencies dropped dramatically as investors worried about increased regulations and the global economic recovery as the Delta virus spread across the globe.

What is the future of Clover Finance?

Clover Finance is a project with many sponsors, including several major cryptocurrency exchanges and investment institutions such as Polychain Capital, Divergence Ventures and KR1. The project also has many strategic partnerships with notable projects such as Polygon ( MATIC ), Chainlink (LINK) and Fantom (FTM). Clover Finance owes its success to gasless trading and the interoperability the platform has achieved through its trusted 2WP bridging technology.

Furthermore, the project intends to expand into other areas of the cryptographic world. Recently, it announced a partnership with CryptoBlades (SKILL), an RPG based on non-fungible tokens ( NFT ) with a system Play-to-Earn🇧🇷 According to Clover Finance, this partnership kicks off the infrastructure initiative of several chains of NFT games and potentially will enable cross-chain exchange of NFT assets in the future.

Conclusion

Clover can be seen as the final manifestation of a Polkadot parachain, as it solves the widespread lack of interoperability in current DeFi and smart contract infrastructures, as well as the desire for intercommunication between DeFi projects. It is the first project to achieve this.

Clover is also looking to leverage the cross-chain composability features inherent in the Polkadot ecosystem to address some of the most pressing challenges in the field of Decentralized Finance. This includes excessive gas prices and siled and isolated grids, which are already being addressed by other projects.

Clover created an EVM-compatible 2-way peg system to help Ethereum-based applications and their currencies easily migrate to the Polkadot network. A remarkable and well-achieved goal.