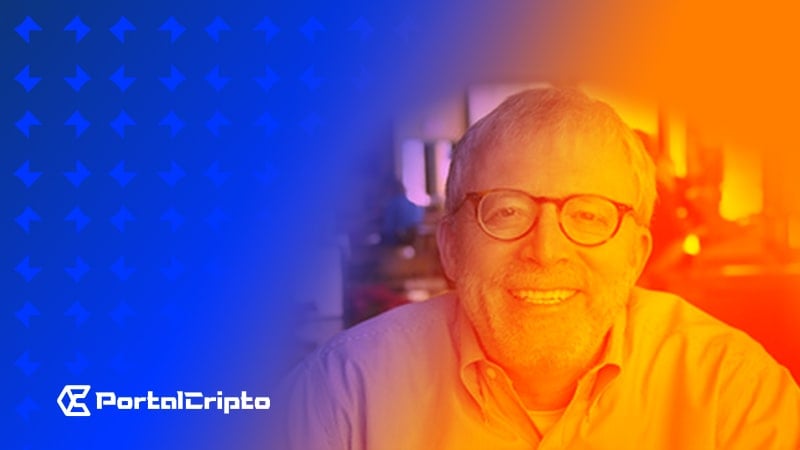

The cryptocurrency analyst Peter Brandt highlighted in a new forecast that the Bitcoin (BTC) could reach new all-time highs next year.

According to Brandt, the largest cryptocurrency on the market probably reached the bottom of the bearish cycle in November 2022. For the veteran trader, BTC is on track to reach new all-time highs in the third quarter of next year.

“Anyone who claims to know the future path of any market is a fool. Markets will ALWAYS surprise. However, with this disclaimer, I believe: 1. The bottom of $BTC is at 2. New ATHs will not arrive until Q2024 3 2. Chop fest However, I have used this plan for approximately XNUMX years,” he wrote.

Anyone who declares they know the future path of any market is a fool. Markets will ALWAYS surprise.

Yet, with this disclaimer, I believe:

1. The $ BTC bottom is in

2. New ATHs not coming until Q3 2024

3. Chop fest in the meantimeI've used this blueprint for approx 2 years pic.twitter.com/hVt0zbTOsm

- Peter Brandt (@PeterLBrandt) October 25, 2023

At the time of publication, the Bitcoin price it was quoted at US$34.147,65, down 1.5% in the last 24 hours. The largest cryptocurrency on the market has been recording significant increases in recent days. BTC showed a growth of 19.5% in the last week.

Experts Make Bitcoin Price Prediction for 2024

Bitcoin price predictions for 2024 do not stop with the community and sector experts speculating an upward rally. Amid growing anticipation over the approval of Bitcoin Spot ETF applications, several financial heavyweights have thrown their cards on the table, indicating where the market is believed to be headed. Bitcoin price may move in the near future.

Matrixport, a renowned platform in the field of financial services in cryptocurrencies, is betting on a more conservative scenario. The company predicts that, with the approval of the ETF, Bitcoin will fluctuate between US$42 thousand and US$56 thousand. The outlook takes into account the impact of the approval of a Bitcoin ETF and the potential inclusion of $50 billion from registered investor advisors.

On the other hand, on-chain data and analytics provider Cryptoquant has a slightly more ambitious vision. In its study on the institutional adoption of Bitcoin, the company projects a flow of almost US$150 billion into the crypto market after the approval of ETFs. According to this analysis, such an influx could increase the value of Bitcoin to a range of US$50 to US$73.