Binance, one of the world's largest cryptocurrency trading platforms, has reached a new regulatory milestone by receiving a virtual asset securities provider (VASP) license from the Dubai Virtual Asset Regulatory Authority. This development allows Binance's Dubai subsidiary, Binance FZE, to offer its services not only to the retail market, but also to expand its reach to qualified and institutional investors.

Compliant disclosed In a post on the company's official blog, Binance FZE plans to introduce new services in the area of virtual asset lending, which includes lending and management and investment services. This move aims to allow users to take advantage of features such as staking of ETH, BNB Vault and Launchpool, thus expanding the income possibilities of your digital assets.

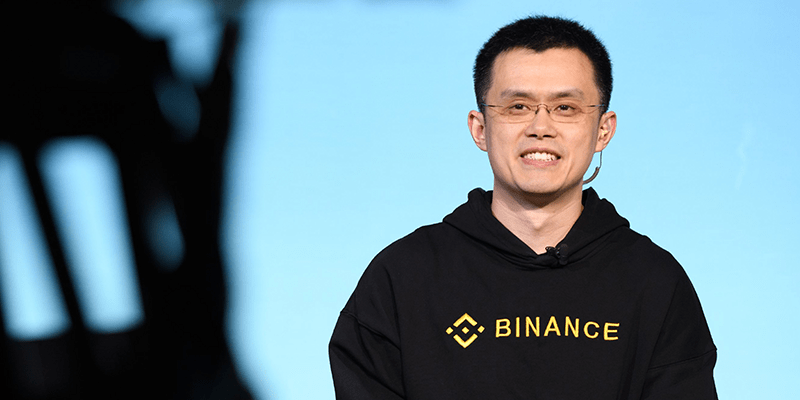

Obtaining the VASP license represents an evolution of the company's position Binance in Dubai, where the company was already operating under a minimum viable product license granted in July 2023. The renewal and extension of this license comes following a series of structural changes to the company's management, including the resignation of Changpeng Zhao to voting control in the entity, shortly after leaving the position of CEO and facing accusations in the United States.

Current CEO Richard Teng commented on the importance of this advancement: “This new license conclusively proves our firm commitment to revolutionizing the future of finance. Achieving this milestone is a solid affirmation of our continued pursuit of transparency, regulatory compliance and responsible growth in the ever-expanding digital asset sphere.”

In addition to these regulatory updates, Binance announced a significant change to its risk management strategy, with the conversion of assets held in its Secure Asset Fund for Users (SAFU) to Circle's USDC stablecoin. The decision to use an audited and transparent stablecoin aims to increase the reliability of the fund, which is normally maintained at a level of US$1 billion. The company clarified that, “We are transferring 100% of SAFU assets to USDC. Making use of a trusted, audited and transparent stablecoin for SAFU further increases its reliability and ensures it remains stable at $1 [billion].”

Amid these changes, tensions persist between Binance and Nigeria, with a company executive still detained in the country. A new report highlights collaboration between the White House and the US Embassy in Nigeria to try to resolve the situation.