According to a report from Glassnode, BTC investors have been holding strong on holding their coins despite the large decline in the cryptocurrency’s price. Data shows that Bitcoin’s “reserve risk” indicator has recently dropped and is now reaching all-time lows seen only in the 2015 bear and March 2020 COVID crash.

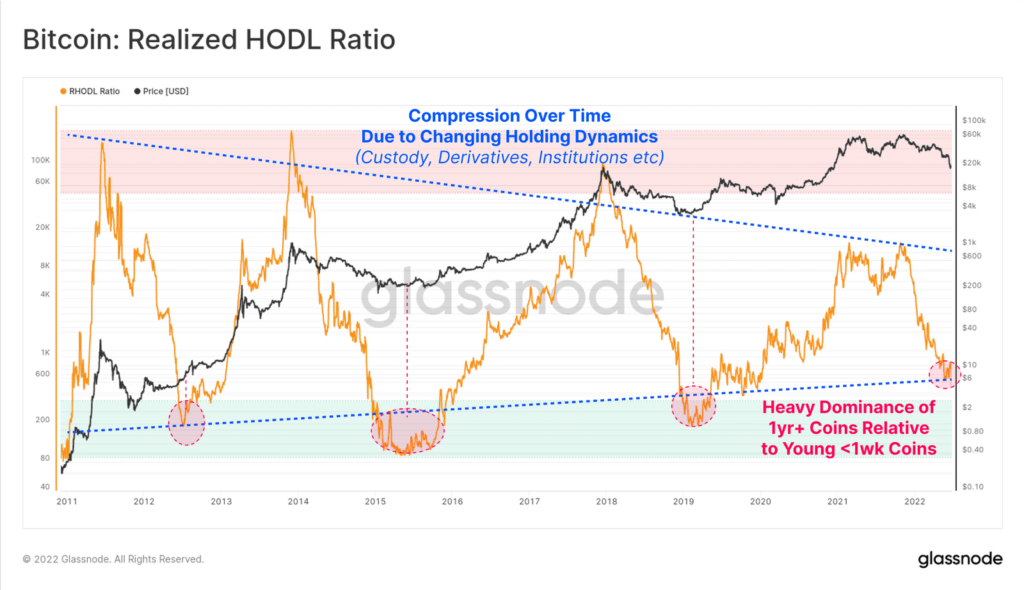

The report says that the RHODL Ratio approaching the lows of the macro range, this indicates that the coin supply is firmly and heavily dominated by these more experienced and long-term investors. On the other hand, there is a clear lack of younger and inexperienced investors, which is synonymous with late-stage bear markets where the investor base is no longer saturated by new and inexperienced demand.

Thus, we can see a strong confluence between reserve risk, dormancy flow and the RHODL index, which suggest that the market remains dominated by strong theses, high conviction investors.

The argument for Bitcoin’s bottoming is based on the observable dominance of strong hand investors, historically significant lows in various macro oscillators, and a strong confluence with prices hovering at an impressive distance from various bear market price models. All in all, it requires a solid thesis and strong conviction to avoid being shaken by Bitcoin’s steep drops.